Uniformity and universality are not hallmarks of retirement plan coverage. A new report offers a look at who in the private sector is most likely to have access to a plan and to be covered.

The Department of Labor’s Bureau of Labor Statistics (BLS) on Sept. 21, 2023 released the March 2023 National Compensation Survey: Employee Benefits in the United States. The information it provides includes retirement plan access and coverage in the private sector.

What the data shows is not entirely unexpected: generally, access to a retirement plan and participation in one is more likely for:

- white-collar employees;

- those who work full-time; and

- those with higher wages.

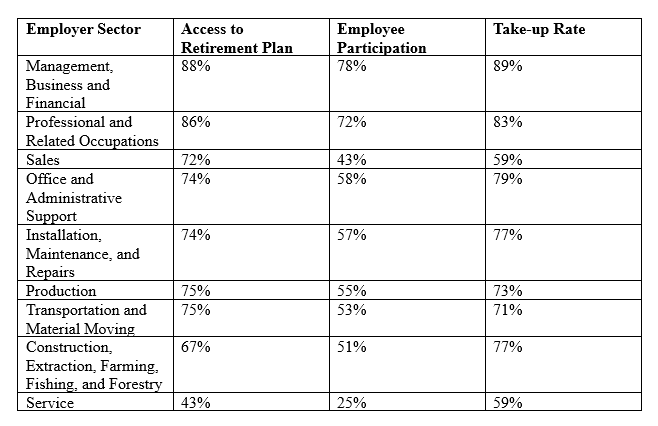

Access and Participation by Type of Business

In general, the BLS data shows that access for, and participation by, employees in white-collar jobs is higher than those who have blue-collar jobs.

More than 80% of those who work as managers, in the business and financial sectors, and in professional jobs had access to retirement plans, and well over 70% participated.

On the other hand, three-quarters of the people who work in the production sector and the transportation and materials moving sector had access, and just over half participated. Similarly, three-quarters of those who work in the construction, extraction, farming, fishing, and forestry sector had access to a plan, and around half participated.

The situation is much more serious for employees in sales occupations. Not even half—just 43%—had access to a retirement plan at all, and only 25% participated.

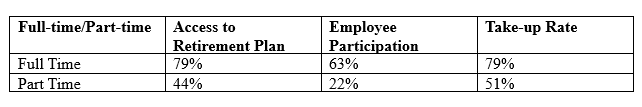

Full-time vs. Part-time

The BLS says that full-time employees were almost twice as likely as part-time employees to have access to a retirement plan, and almost three times as likely to participate in one.

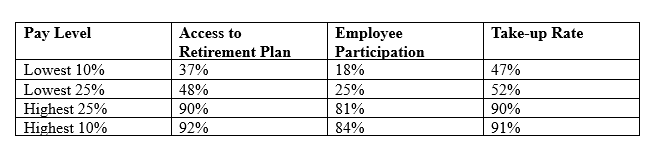

By Pay Level

The starkest difference in access and participation was between the highest and lowest pay tiers. Ninety percent of the top 25% of earners had access to a plan, and they were more than three times as likely to participate. The gap was even bigger for the top 10% and the lowest 10%: those in the highest 10% of earners were 2.5 times more likely to have access to a plan, and they were more than 4.5 times as likely to participate.

- Log in to post comments