While contribution levels have remained consistent, a troubling trend is that many individuals increasingly have been tapping their retirement savings through hardship withdrawals or loans.

This is according to the latest data from Fidelity Investments’ Q3 2023 retirement analysis, which shows that 2.3% of workers took hardship withdrawal, up from 1.8% in Q3 2022. Notably, the top two reasons behind this uptick were avoiding foreclosure/eviction and medical expenses.

At the same time, inflation and cost of living pressures have resulted in increased loan activity over the last 18 months. In Q3, 2.8% of participants took a loan from their 401(k), which is flat from Q2 and up from 2.4% in Q3 2022. The percentage of workers with a loan outstanding has increased slightly to 17.6%, up from 17.2% last quarter and 16.8% in Q3 2022.

Similarly, in-service withdrawals—where an individual may choose an in-service withdrawal rather than a loan if they prefer to assume taxes and penalties and not have to repay the amount they withdraw—inched up in Q3, rising to 3.2% of participants, up from 2.7% from a year ago.

And while savings rates remain steady, juggling the short-term has become a persistent problem, as Fidelity research shows 8 in 10 Americans say inflation and the cost-of-living are causing stress, with most U.S. adults (57%) unable to afford even a $1,000 emergency expense.

Consequently, Fidelity suggests that the increasing use of hardship withdrawals and loans underscore the need to help retirement savers develop emergency savings, which the firm has found to be the No. 1 savings goal among employees, after retirement.

Account Balances Decreased

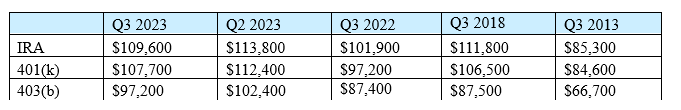

Additional findings show that, while account balances have decreased slightly since last quarter, 401(k) balances are up double digits over the long term and from one year ago.

For instance, the average 401(k) balance decreased to $107,700, down 4% from Q2 2023, but an 11% increase from a year ago and 27% increase from 10 years ago. For 403(b)s, the average account balance decreased to $97,200, down 5% from last quarter, but up 11% from last year, and a 46% increase from 10 years ago.

Average Retirement Account Balances

Meanwhile, despite balances decreasing in the short term, total 401(k) and 403(b) savings rates remain steady. The total savings rate for the third quarter, reflecting a combination of employee and employer 401(k) contributions was 13.9%, consistent with Q2 and up slightly from a year ago.

Fidelity notes that the savings rate remains just below its suggested savings rate of 15% (including both employee and employer contributions). Perhaps not surprisingly, Boomers in the workforce continue to save at the highest levels (16.7%).

“Americans have become accustomed to riding the economic waves of the past several years, and this quarter is no different,” said Kevin Barry, president of Workplace Investing at Fidelity Investments. “They are learning how to stay afloat in very challenging financial conditions—including having enough money set aside should an emergency arise. Through it all, we are pleased to see retirement savers continue to stay the course with steady savings rates and continued commitment to their futures.”

Gen Z Favoring IRAs?

One interesting finding from Fidelity’s analysis is that Gen Z continues to make strides on the retirement savings front, particularly in IRA accounts.

Here, Fidelity notes that the total number of IRA accounts rose to 14.6 million, an 11% leap over this time last year (Q3 2022). Total assets also increased 19% in the last year. But for Gen Z investors, Fidelity found a 63% increase in IRA accounts year-over-year and overall dollar contributions increasing 51%. The third quarter also saw a 69% increase for females in this age bracket.

Across generations, Roth IRAs continue to be the preferred retail retirement savings vehicle, with 61.2% of all IRA contributions going to Roth.

Meanwhile, the balance for Gen Z workers who have been in their 401(k) plan for five years straight reached $29,100 in Q3, showing the power of staying in the same plan, with the same employer, for an extended period of time.

“It’s impressive to see Gen Z entering the workforce and prioritizing retirement savings,” said Rita Assaf, head of Retirement Products. “While market conditions are constantly changing, the benefit of making consistent contributions over the long-run is clear—a more secure retirement.”

Fidelity’s Q3, 2023 analysis is based on the savings behaviors and account balances for more than 45 million IRA, 401(k), and 403(b) retirement accounts.

- Log in to post comments