The differences between low-income and high-income older workers’ retirement accounts were greater in 2019 than in 2007, according to a new analysis by the Government Accountability Office (GAO).

Known as Congress’ investigative arm, GAO’s analysis of Survey of Consumer Finances (SCF) data on households aged 51 to 64 finds, for example, that about 1 in 10 low-income households had a retirement account balance in 2019 compared to about 1 in 5 in 2007. In contrast, about 9 in 10 high-income households had a balance through the period.

The report—Retirement Account Disparities Have Increased by Income and Persisted by Race Over Time—also highlights the huge portion of Americans who lack any retirement savings at all. As of 2019, 9 in 10 of the lowest-income older households had no savings in a retirement account. In fact, the share of the lowest-income households with any retirement account balance decreased from 21% in 2007 to about 10% in 2019.

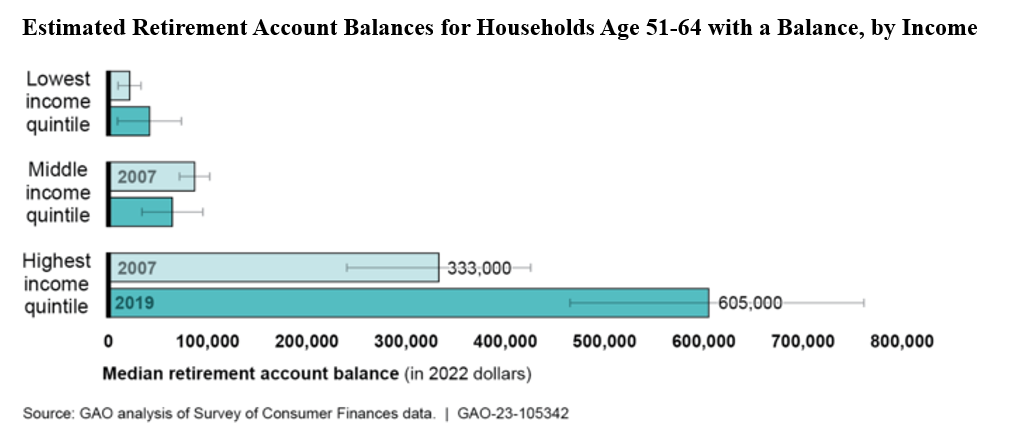

For those with a balance, the median account balance for high-income older households nearly doubled from $333,000 to $605,000 over that time, while the median account balance for middle-income older households stagnated at about $64,300.

Racial disparities also persisted over the period. GAO found that a higher share of white households had a balance than those of all other races. For example, in 2019, about 63% of white households had a retirement account balance compared to about 41% of households of all other races. Among households that had retirement savings in 2019, white households had double the median balance of all other races ($164,000 to $80,300, respectively).

GAO note: Brackets represent 95% confidence intervals. Overlapping brackets for the lowest and middle-income quintiles indicate no statistically significant difference between 2007 and 2019.

Contributing Factors

Meanwhile, income and job-related factors were also strongly related to disparities in older worker households' retirement account balances. This is according to GAO's analysis of 2018 Health and Retirement Study (HRS) data.

High-income households contributed a larger percentage of their pay than low-income households (about 8% and 5%, respectively) and received larger employer contributions. Not surprisingly, households with higher income, longer job tenure, and a college education tended to have larger balances. Households of all races other than white and households with children had about 28% and 20% smaller balances, respectively.

Notably, the effects of selected strategies meant to increase workplace retirement savings vary across workers of different income groups, according to illustrative scenarios using GAO's analysis of SCF and HRS data.

For example, automatic enrollment can increase participation of low-income older workers with access up to about a third. However, only about 23% of low-income workers have access to a workplace retirement account, compared to about 75% of high-income older households. Further, low-income workers may choose not to participate, for example, if they have limited disposable income or expect Social Security to provide most of their retirement income, GAO notes.

In contrast, increasing contribution limits for workplace retirement accounts almost entirely benefits high-income workers, as about 23% of high-income compared with about 3% of middle-income older workers contribute the individual limit.

Why GAO Did This Study

The report was first commissioned in 2020 by Sen. Bernie Sanders (I-Vt.), who is currently Chairman of the Health, Education, Labor, and Pensions Committee, and Sen. Sheldon Whitehouse (D-R.I.), Chairman of the Budget Committee, who asked GAO to examine disparities in the distribution of retirement account balances.

In 2022, for example, the tax incentives for workers to save in tax-preferred retirement accounts cost the federal government nearly $200 billion in forgone revenue, according to the Department of the Treasury. GAO notes that members of Congress and others are concerned these incentives accrue primarily to high-income workers and not low-income workers.

“At a time when half of older Americans have no retirement savings at all, it is unacceptable that taxpayers are forced to spend billions of dollars subsidizing the retirement accounts of the wealthiest people in America,” Sen. Sanders said in a statement upon release of the report. “In America today, 55% of seniors are trying to survive on less than $25,000 a year. Given that reality, our job is to make sure that the working class in our country are able to retire with the dignity and the respect that they deserve, not to provide more tax breaks to the billionaire class.”

“Auto-enrollment in workplace retirement accounts would reduce the access gap and make it easier to save, but we must also protect Social Security for all and ensure the wealthy pay their fair share so that all can retire with financial security,” added Sen. Whitehouse.

- Log in to post comments