The last time I wrote for ASEA Monthly, I weaved an intricate tale of the House of Dragons TV series and its relation to our actuarial responsibilities, nay, duties to receive continuing education in the topics of ethics and bias.

This time, my mission is easier: mortality table updates! It's everyone's favorite topic; even my office mate (a.k.a. cat) Miss Purry loves the topic because it sounds like purr-tality to her. My other cats are more ambivalent. After an exceptionally long wait, the IRS published the mortality tables used for IRC 417(e)(3) minimum lump sum calculations and final regulations that govern mortality tables for funding valuations with valuation dates on or after Jan. 1, 2024.

Applicable Mortality Tables for 2024 Distributions

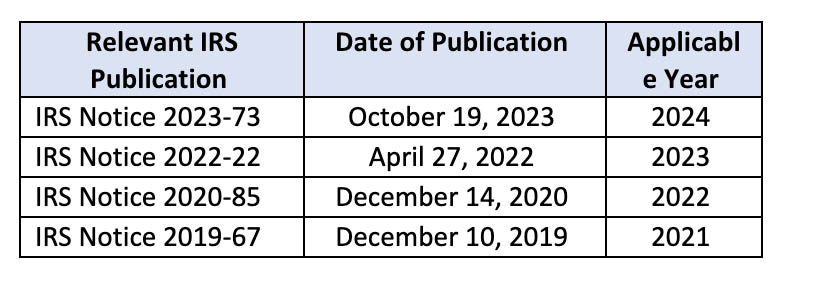

The easy start to this article begins with the Applicable Mortality Table, which is used for the IRC 417(e)(3) minimum lump sum calculations for distributions beginning in 2024 that the IRS published in IRS Notice 2023-73 on Oct. 19, 2023. In the last few months, many of my water cooler conversations (with my cats, naturally, since I work from home) centered around when the new table would be published. Miss Purry suggested I perform a trend analysis for how many months of lead time we got between the publication of the tables and the applicable year start date. Since the applicable year 2021, we've had a lead time of 13 months, 13 months, nine months, and three months, respectively. The time that practitioners (and potential recipients of lump sums who are planning ahead) are getting to prepare estimates is getting shorter. Are we reaching a point where the 2025 tables will be published sometime in 2025? Miss Purry quickly reminded me that trend analysis isn't a failproof predictor of future trends, but let's hope not.

Mortality Tables for Funding Valuations on and after Jan. 1, 2024

For the last few funding valuation years, the same IRS Notice that published the Applicable Mortality Table for the year included the funding valuation tables. This year, we get the 2024 funding tables through final regulations instead of a notice. For valuations on or after Jan. 1, 2024, the IRS issued Final Regulations on Oct. 20, 2023, to 1.430(h)-1 – Mortality tables used to determine the present value for the calculation of the funding results under §IRC 430(h)(3)(A) used to determine the minimum contribution and maximum deduction contribution.

The Final Regulations finalize the proposed regulations released in April 2022 while incorporating requirements included in SECURE 2.0 described below. In a nutshell, all plans are now required to use generational mortality tables unless they meet the small plan exemption (500 or fewer participants as of the valuation date), in which case they can choose to use static combined mortality tables.

The Final Regulations include the following rules for the use of mortality tables:

- Elimination of Static Tables Except for Small Plans – Proposed regulations from April 2022 were adopted with respect to eliminating the use of static tables except for small plans. Under the Final Regulations, only plans with 500 or fewer participants (active, terminated vested, and those receiving payments) are permitted to use Small Plan Static Combined mortality tables as of the plan's valuation date. All other plans must use the generational mortality tables, which combine the use of Base Mortality Tables and Mortality Improvement Rates (sometimes referred to as projection scales) and are referred to as the Standard Mortality Tables in the Final Regulation.

- Base Mortality Tables – The Base mortality tables adopted in the Final Regulations are based on the Pri-2012 Private Retirement Plans Mortality Tables Report (Pri-2012 Report) released by the Retirement Plan Experience Committee (RPEC) of the Society of Actuaries (SOA) in 2019. According to Miss Purry, the Pri-2012 Report included 72 unique mortality tables. Small differences exist between the SOA's Pri-2012 tables and the IRS Pri-2012 tables published in the Final Regulations. The IRS began with the amounts weighted version of the employee and annuitant mortality tables published by the SOA but with some modification (which is outlined in the 2017 IRS Proposed Regulations). The subset of Pri-2012 Base mortality tables included in the Final Regulations published by the IRS are gender specific and available in annuitant and non-annuitant versions for a total of 4 published tables.

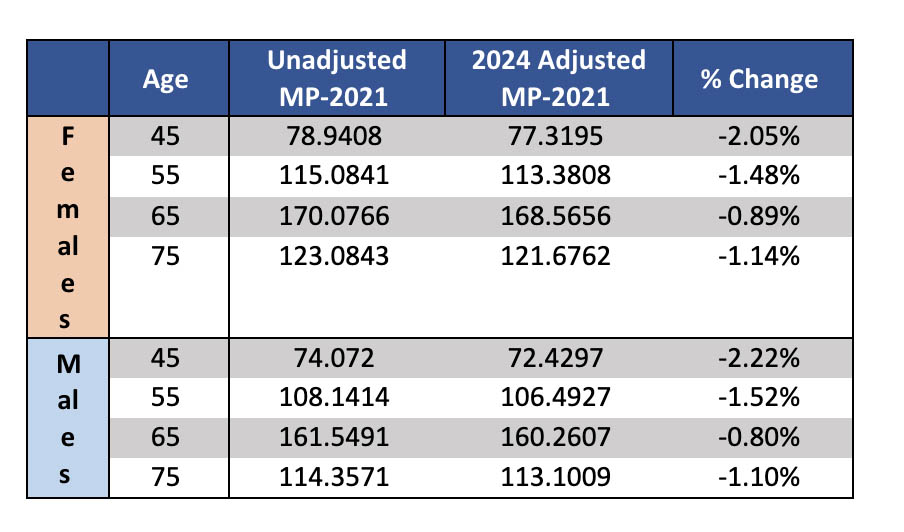

- Mortality Improvement Rates – In October 2021, unadjusted mortality improvement rates were included in the Mortality Improvement Scale MP-2021 Report (MP-2021 Report) published by the RPEC. Section 335 of the SECURE 2.0 Act imposed a cap of 0.78 percent on the mortality improvement rates for valuation dates occurring in 2024 and later. The Final Regulations adopted the 2024 Adjusted Scale MP-2021, which applies the 0.78 percent cap imposed by SECURE 2.0 to the unadjusted MP-2021 Report mortality improvement rates. The 2024 Adjusted Scale MP-2021 Rates are gender specific.

- Static Combined Mortality Table Option for Small Plans – The Final Regulation permits small plans to use combined static mortality tables for plans with valuation dates on or after Jan. 1, 2024, instead of using the generational mortality tables. The Small Plan Static Combined Mortality Tables are gender specific.

- Individuals Not Identified as Male or Female – The Final Regulations provide that the plan's actuary must use a reasonable approach in applying the §IRC 430(h)(3)(A) mortality tables for the portion of the plan's population whose gender is not identified. The Final Regulations include two examples of reasonable approaches that may be used, but other approaches may also be reasonable. The two examples provided in the Final Regulation are: 1) a weighted approach between male and female liability reflecting a gender distribution in the plan's population, and 2) assigning male or female status randomly to an individual based on plan demographics for those individuals who are not identified as male or female.

- Applicability Date – The Final Regulations apply for funding valuation dates occurring on or after Jan. 1, 2024.

To recap, under the Final Regulations, all funding valuations on or after Jan. 1, 2024, are required to use generational mortality tables as the standard, or default, mortality assumption. Small plans may use static combined mortality tables instead IF they meet the 500 or fewer participants requirement as of the valuation date.

There are nuances that actuaries should be mindful of based on the Final Regulations:

- Small Plan Assumption Changes – The Final Regulations provide welcome relief to small plans by allowing the use of static combined male and female mortality tables but eliminating past years' options of using annuitant and non-annuitant versions (each gender specific) of static mortality tables.

Small plans that used annuitant and non-annuitant versions of static mortality tables for their previous funding valuations should expect to run valuations on Jan. 1, 2024, and later with different mortality assumptions: either the generational mortality tables or the static combined mortality tables.

Miss Purry was quick to remind me that in Revenue Procedure 2017-57, Section 3.02(c), Example 1 treats a change from a projected static mortality table to a generational mortality table as an assumption change. This should clarify questions from practitioners who might believe that the change would be considered a method change.

- Future Changes to Published Mortality Tables – The generational mortality tables included in the Final Regulations may or may not change for funding valuations on or after Jan. 1, 2025. Factors that would affect future updates include: 1) the publication by the Society of Actuaries of new base mortality tables reflecting updated mortality studies, 2) the publication of new mortality improvement rates, and 3) statutory changes to the 0.78 percent cap applied to mortality improvement rates imposed by SECURE 2.0.

The Final Regulation included a note that the Small Plan Static Combined Mortality Tables would be updated in later years to reflect updates for mortality improvement.

- Impact on ASC-715 Accounting Valuations – The base table and mortality improvement rates are prescribed for funding valuations under the Final Regulations but for accounting valuations, assumptions are not prescribed. Instead, accounting valuation assumptions (including mortality assumptions) are selected by the corporate sponsor (sometimes with input from the plan actuary). Unless a corporate sponsor chooses to use the same mortality tables for their accounting valuation as the ones published in the Final Regulations, there would be no impact on the accounting valuation.

For many accounting valuations, the base tables and mortality improvement rates used have traditionally been those published by the SOA without adjustment. The base tables published by the Final Regulations for funding differ slightly from the Pri-2012 SOA base tables. The mortality improvement rates used for accounting valuations are not subject to the .078 percent cap imposed by SECURE 2.0. That is, funding valuations must use the 2024 Adjusted MP-2021 mortality improvement rates, but accounting valuations may use the unadjusted MP-2021 rates, the 2024 Adjusted MP-2021, or another set of mortality improvement rates so long as the corporate sponsor of the plan determines an appropriate assumption.

- Impact of SECURE 2.0 0.78 Percent Cap – I was curious about the impact of the 0.78 percent cap in SECURE 2.0 on the mortality improvement rates. For a few sample ages, using the same base mortality tables (the gender distinct Annuitant and Non-Annuitant versions prescribed in the Final Regulations), how much do the Present Value Factors (PVFs) differ between using the unadjusted MP-2021 vs. the 2024 Adjusted MP-2021 mortality improvement rates? Miss Purry was very confused by this analysis because she was under the impression that "MP" stood for "Miss Purry." The following table was developed based on a 4% interest rate and sample ages (with payments deferred to age 65) to illustrate the percentage impact of the two sets of mortality improvement rates for male and female participants. Actuaries should generally expect to see a slight decrease in retirement liabilities when using the same base table but using the 2024 Adjusted MP-2021 mortality improvement rates that reflect the 0.78 percent cap imposed by SECURE 2.0 compared to the unadjusted MP-2021 mortality improvement rates. The base table for the illustration was the base tables published in the Final Regulations.

Proposed Regulations for Plan-Specific Substitute Mortality Tables

For plans using substitute mortality tables, Final Regulations were adopted on Oct. 5, 2017, covering the eligibility, development, and use of substitute mortality tables for the calculations of funding results under §IRC 430(h)(3)(A) used to determine the minimum contribution and maximum deduction contribution.

On Oct. 20, 2023, proposed regulations were released, which included updates to the requirements to use plan-specific mortality tables. While the proposed regulations retain the methodology for the development of substitute mortality tables adopted with the 2017 Final Regulations, they also added rules regarding the use of mortality experience data for the COVID-19 pandemic period. The comment period for the proposed regulations closes on Dec. 19, 2023. The proposed regulations are anticipated to be effective for valuations on or after Jan. 1, 2025.

Conclusion

Mortality tables are the bread and butter of our actuarial valuations. The Final Regulations herald a new norm for pension actuaries, requiring the use of generational mortality tables. While most software programs are already programmed to use generational mortality tables, the Final Regulations gave an exemption to use static combined tables instead as long as the purrrrticipant (Miss Purry get away from the keyboard!!!) count is 500 or less as of the valuation date.

In the future, the IRS will review and update the generational mortality tables required for funding valuations. And I will continue to spend my time talking to my cats at the water cooler, wondering when those updates will become available.

- Log in to post comments