Financial wellness remains one of the most bandied about phrases in our industry—it’s something most aspire to, something plan sponsors are both interested in—and skeptical about—something that seems to have an elusive ROI, at least in objective, quantifiable terms—and yet…

Financial wellness has been on the radar for some time now, though plan sponsors have, as a group, been relatively skeptical—not of the need, but about the efficacy of the delivery, and the ability to quantify the value relative to the cost.

However, the COVID-19 pandemic cast a new light on financial wellness as an essential workplace benefit, and a growing majority of employers feel extreme responsibility for their employees’ financial wellbeing. The growth of financial wellness programs in the workplace also means that expectations have shifted.

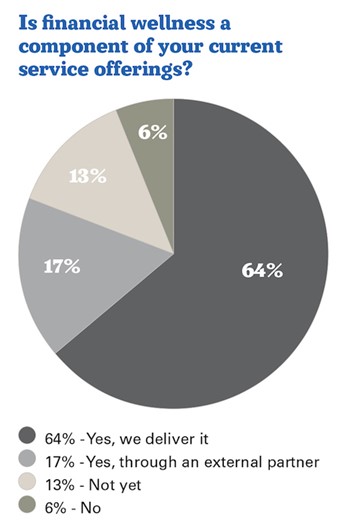

And yet, as indicated by the respondents to this year’s NAPA Summit Insider, it is increasingly an element in the service delivery of a majority of advisory firms.

That said, the definition appears to be nearly as fluid and numerous as the firms that employ it. Here’s a sampling of the responses from this year’s Summit Insiders:

How would you define financial wellness?

Holistic financial literacy and ability to deliver something that helps individually. We have a couple of plans that use Dave Ramsey’s program and we formulate delivery of education around what plan sponsors receive from the program.

What financial needs do the employees have and how can I meet them?

We offer what I would define as “wellness plus.” We engage employees in annual individual meetings. They are allotted approximately 20 minutes to speak/meet with a financial professional (we have 2 CFPs and 2 CPFAs) who are work with employees (participants). Notes on each meeting are documented and reviewed prior to new session to ensure a contiguous experience for those we meet with. Much of what we do is education based, but for someone who needs more help to give them confidence, we do have the tools and offering to do so. It creates extreme piece of mind and employees will often come to us before speaking with HR.

We believe the term is outdated and frankly obsolete. We believe the next paradigm is offering institutionally priced Financial PLANNING services by a CFP as an employee benefit. We see this is either a voluntary benefit paid by employees or even something 100% employer paid.

Varies by client.

Using actual metrics to make a participant feel confident in their current and future financial situation.

Usable financial education on key topics—best practices.

Tough to define exactly. This involves a number of things including KNOWLEDGE related to debt management (and true cost of borrowing), budgeting, creating an emergency savings reserve, contributing no less than what is required to receive the maximum employer match contribution (and consideration of whether Roth or

Pre-Tax 401(k) contributions are appropriate), a basic understanding of how social security retirement benefits are calculated, up-to-date beneficiary designations, utilizing tax-advantaged college savings accounts, where it is prudent do so.

The state of being in good financial health, especially as an actively pursued goal. Meaning, that you are not just currently healthy, but actively working on maintaining financial health. I kind of equate this to having a gym membership, versus actually going to the gym. You may be healthy today, but do you just drive by and wave at your gym, or are you actively maintaining your health by using the tools at your disposal to ensure your own long-term health?

The resources and the tools to prepare a participant for retirement. The ability for a participant to achieve financial goals and best utilize their employers 401(k) and the recordkeepers platform.

The million dollar question... Also, how do you track progress towards it!? I would say Financial Wellness is having the awareness, knowledge, and tools to make financially sound decisions.

The definition is slippery. I would define it broadly as assisting plan participants with personal financial strategies and tools beyond the act of saving for retirement.

The basics of budgeting, debt management, investing, retirement/estate planning & social security.

The agility to holistically coordinate all aspects of an individual’s financial situation into a comprehensive view and plan.

That’s a great question that I don’t think I’ve ever seen the answer to. Everyone talks about it but I don’t know that I know what it is. Educating the participants about more than the 401k? Explaining the importance of a budget, emergency savings and good vs bad debt?

That’s the million dollar question. Everything from financial basics like debt and budgeting up to college planning and retirement, and up to complete financial planning. We deliver short “tidbits” that cover finance basics to all sponsors for distribution to participants.

Reduced stress knowing that your financial matters are on the right path.

Participants understanding the fundamentals of finance and planning for their current finances as well as their retirement.

Overall financial health of an individual including but not limited to the ability to manage day-to-day finances while meeting their individual savings goals.

Offering more than just advice on investments. We incorporate budgeting, debt reduction, college planning, and income projection.

Meeting all aspects of an employee’s financial health (banking, credit scores, planning, 529, etc.).

It varies by client and needs to be flexible for each client to determine.

In the eye of the beholder. Similar to an education strategy, we work with client to determine what is best for client. It typically has a component of improving financial literacy (understanding) of how a person manages their short term, mid-term and long term goals and how they will pay for them. There can be an aspect of debt management too. We work with recordkeeper partners and in some cases recommend or present specific wellness programs.

Improving employee financial knowledge, showing employees their current financial situations, helping them define goals, helping them see how they can reach those goals.

Holistic participant help, planning, and tools related to their financial situation both for retirement and day to day life.

Helping employees identify and work toward solving issues with their finances so that they may absorb financial shocks short term and be prepared for the long term.

Helping employees build and maintain a strong financial foundation. This includes emergency savings, budgeting, high-interest debt reduction, and saving for retirement.

Giving the participants all the tools to make their entire financial situation more comfortable and having an individual available to explain whatever it takes to make the participant confident to retire on their terms.

Financial wellness is living within your means, saving appropriately for unexpected events, planning for large purchases, and saving sufficiently to maintain one’s lifestyle in retirement.

Financial Wellness is beyond traditional benefit and compensation programs, the focus on the well being of employees, helping them to relieve stress and anxiety in their personal lives, and thus improve productivity and the level of employee engagement simultaneously.

Financial wellness is an understanding of where you are financially in your journey and where you need to be going forward. And having a plan to accomplish those goals that you have set for your future.

Financial wellness allows employees to take control of their financial future and become educated and prepared.

Extending education beyond just the 401k but to a more holistic approach.

Delivering a financial literacy resource to couple with a holistic financial planning offering both on-site and virtually.

Being financially prepared for emergencies. ?Having access to the information and tool necessary to make good financial decisions. ?Having a plan for the future.

A wholistic endeavor touching all areas of a person’s financial wellbeing.

A system of behaviors that result in one’s financial security.

A state of financial literacy that allows an individual (or family) to live the quality of life they desire in a manner that is primarily anxiety-free.

A robust combination of programs that are designed to help move individuals from a state of financial stress to one of financial confidence and well being.

- Log in to post comments