Editor’s Note: This is the third in a three-part series on pension plan funding. It features discussions with Brad Smith, Partner at consultant and investment firm NEPC and member of its Corporate Defined Benefit Team. The first installment is here; the second is here; this one looks at trends and what lies ahead.

What has been the overall pension funding trend for private-sector DB plans in the period 2011-2021? “The overall trend over the last decade is that plan sponsors continued to refine their investment strategy and, overall, improved their funded status dramatically,” says Smith. “Over the last 10 years,” he continues, “while we did not see an increase in LDI adoption, we saw plan sponsors move along their glide path and increase assets to fixed income.”

Smith notes that U.S. equity returns during the first eight months of the year standing at 21.6%, according to the S&P 500, while long credit returns were -0.7%, according to Bloomberg Barclays Long Credit. He said that those results indicate that plan liabilities fell—using long credit returns as a proxy—and return-seeking assets improved—using S&P 500 as a proxy—which, he says “led to funded status improvement as assets improved and liabilities fell.”

“In NEPC’s Defined Benefit Plan Trends Survey, 87% of plans utilizing LDI and glide paths stated they hit a trigger on their glide path since January 2021,” Smith says. “Of these plans that hit a trigger, 89% indicated it was due to market movements.”

Looking Deeper

Beyond the increase in the number of plans that have a funded status of more than 100%, what has the trend been regarding pension funding? Smith responds, “We have seen two notable trends with well-funded plans. First, we continue to see frozen plans with funded status above 100% de-risk their portfolios to lock-in funded status gains. Second, we have also seen plan sponsors make voluntary contributions to ensure plans stay above 100% to avoid variable rate PBGC premiums.”

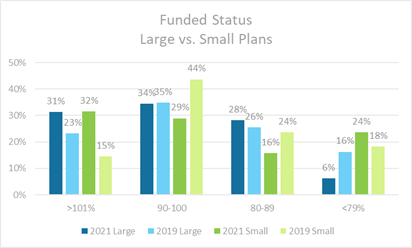

And how are improvements in funded status distributed? Is there a difference between large plans and small plans? Overall, Smith says, funded status has improved over the last two years for both large plans—which NEPC defines as a plan with assets of more than $1 billon—and small plans, which NEPC defines as a plan with assets of under $1 billion. But small plans actually saw the largest percentage increase—a 17% jump to a funded status above 101%.

Looking Ahead

Looking Ahead

Smith says that NEPC expects that in the next 10 years, sponsors of private-sector DB plans will continue to manage them based upon their unique goals and objectives. Some plan sponsors will seek to maximize risk-adjusted returns while other sponsors will seek to minimize funded status volatility.

Smith notes that NEPC expects that the majority of open plans will remain open, and notes that 63% of open plans stated they expect to remain open in their 2019 survey. The most frequently expressed reason those plans expect to stay open, he says, “is because they believe contribution and funded status volatility risks are currently being managed.” Smith adds that NEPC also expects frozen plans to implement more risk-management strategies such as hibernation strategies and/or opportunistic de-risking strategies, such as lump-sum payments and pension risk transfers.

- Log in to post comments