Where do things stand regarding retirement assets and plan participation in the United States? Two agencies give us a look.

Assets

U.S. retirement assets as of New Year’s Eve in 2022 stood at a total of $37.8 trillion, says the Congressional Research Service (CRS) in U.S. Retirement Assets: Data in Brief. That breaks down thusly:

- Employer-sponsored plans: $26.3 trillion

- IRAs: $11.5 trillion

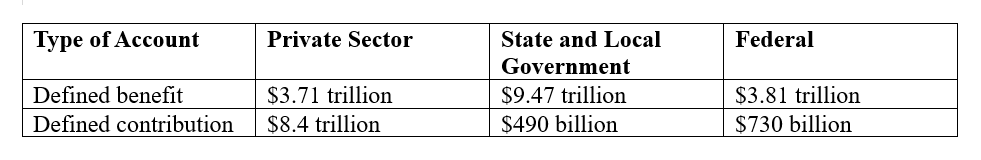

DB and DC plan assets. The CRS notes that In 2022, as in most years, government-sponsored plans accounted for most of the assets held in defined benefit plans. Conversely, private employer-sponsored plans accounted for a majority of assets held in defined contribution plans.

Here’s a closer look at the year-end results for DB plans and DC plans, according to the CRS:

Trends. The CRS says that during the period 2013 to 2022:

- Total real (inflation-adjusted) retirement assets grew by $4.4 trillion (13.3%).

- Total real retirement assets peaked at $44.3 trillion in 2021.

- The growth in IRA assets contributed most to retirement asset growth with a $2.8 trillion real increase from 2013 to 2022.

- DC plans sponsored by the federal government grew by the greatest percentage rate at 43.4%.

- Holdings of financial assets by private-sector DB, federal DB, and state and local DC plans all decreased when adjusted for inflation.

The CRS report says that retirement plan holdings included a variety of financial assets, including equities, securities, debt, mutual funds, claims on owed sponsor contributions, and other financial assets.

The CRS draws on data from the Federal Reserve’s Financial Accounts of the United States, which provides information on the amount of retirement assets in the United States.

Coverage and Participation

The CRS says that approximately two-thirds of U.S. households had a financial stake in the U.S. retirement system in 2019 (other than Social Security).

The CRS further reports that according to the Federal Reserve’s Survey of Consumer Finances (SCF), in 2019, among all U.S. households:

- 63.3% had DC assets, participated in DB plans, or had IRA assets;

- 37.5% had DC assets;

- 30.2% participated in DB plans; and

- 5.4% had IRA assets.

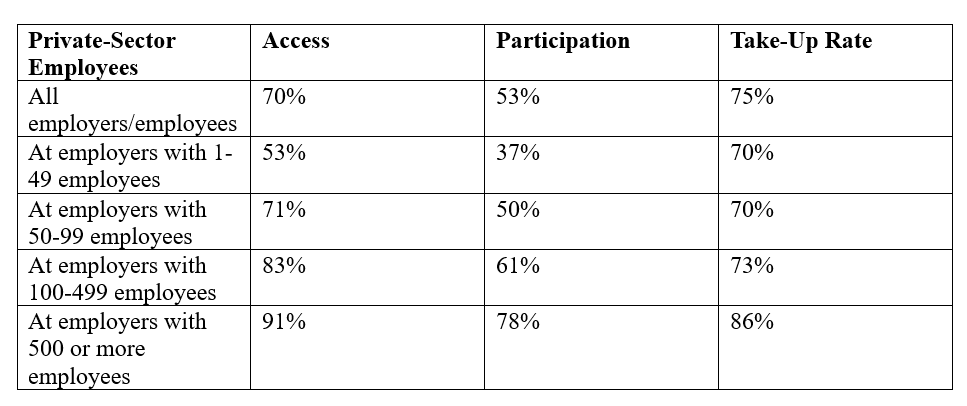

More recently, the Bureau of Labor Statistics’ March 2023 report shows that employees of large employers were the most likely to have access to a retirement plan and participate in one. They report that retirement plan access, participation, and take-up rates among private sector employees increased consistently as the size of the employer’s workforce increased—the larger the employer, the higher the access and the larger the participation.

More specifically, participation among private-sector employers and employees, based on employer size, looked like this:

- Log in to post comments