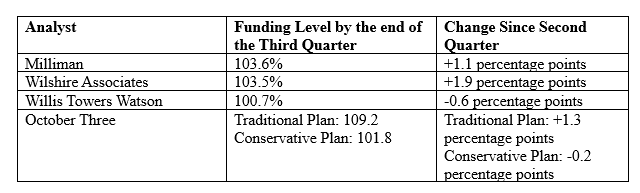

Summer—also known as the third quarter—brought some sunshine for private-sector pension plans in 2023.

Funded Status

By three measures, private-sector defied benefit plans gained ground in their funded status in the third quarter. Two gauges report slight drops; however, those decreases were less than 1 percentage point; further, both also reported more than 100% funding even with those small drops.

Sweta Vaidya, Head of Solution Design at Insight Investment, reported a 2.5-percentage point improvement in private-sector DB plan funded status in the third quarter. Vaidya told ASPPA Connect that the firm attributes the improvement in funded status during the third quarter largely to a 125-basis point increase in liability discount rates. That, Vaidya explains, “decreased liabilities significantly even as asset returns were volatile.”

Digging deeper, Milliman says that funded status of the Milliman 100—the 100 largest U.S. corporate pension plans—did not rise consistently throughout the third quarter. Milliman says the funded status fell in August, but it was bookended by rises in July and September. In dollars and cents, the funded status of the Milliman 100 fell by $6 billion in August, but ended the quarter with an overall improvement of $12 billion.

Liabilities

Aon reports that in the third quarter, pension liabilities fell. Willis Towers Watson says the drop was dramatic—the pension liabilities of the WTW 300 by Sept. 30 at the end of the third quarter were half of the $20 billion of June 30.

Assets

Assets were not part of the third quarter warmth, according to Aon, which reports that return-seeking assets were down. Milliman reports asset gains in July, but asset returns in August and September that “were significantly below expectations.”

- Log in to post comments