July is a good time to take stock of where things stand with respect to the multitude of state laws and programs to address the retirement plan coverage gap in the private sector workforce. By the time July rolls around on the calendar all but a handful of state legislatures have completed their sessions. Also, July 1 is a common trigger date when many state laws and programs become effective in general.

July is a good time to take stock of where things stand with respect to the multitude of state laws and programs to address the retirement plan coverage gap in the private sector workforce. By the time July rolls around on the calendar all but a handful of state legislatures have completed their sessions. Also, July 1 is a common trigger date when many state laws and programs become effective in general.

It has been 11 years since California and Massachusetts in 2012 became the first states to pass laws creating state-sponsored retirement programs for private-sector workers. The two states adopted very different models. Massachusetts took the voluntary road, creating what would become the Massachusetts Defined Contribution CORE Plan, a full-blown 401(k) plan that was made available to small nonprofit employers. California took the mandatory road, eventually requiring every employer in that state, from the self-employed on up, to offer some type of retirement benefit for their employees and creating the CalSavers program to help businesses meet that requirement.

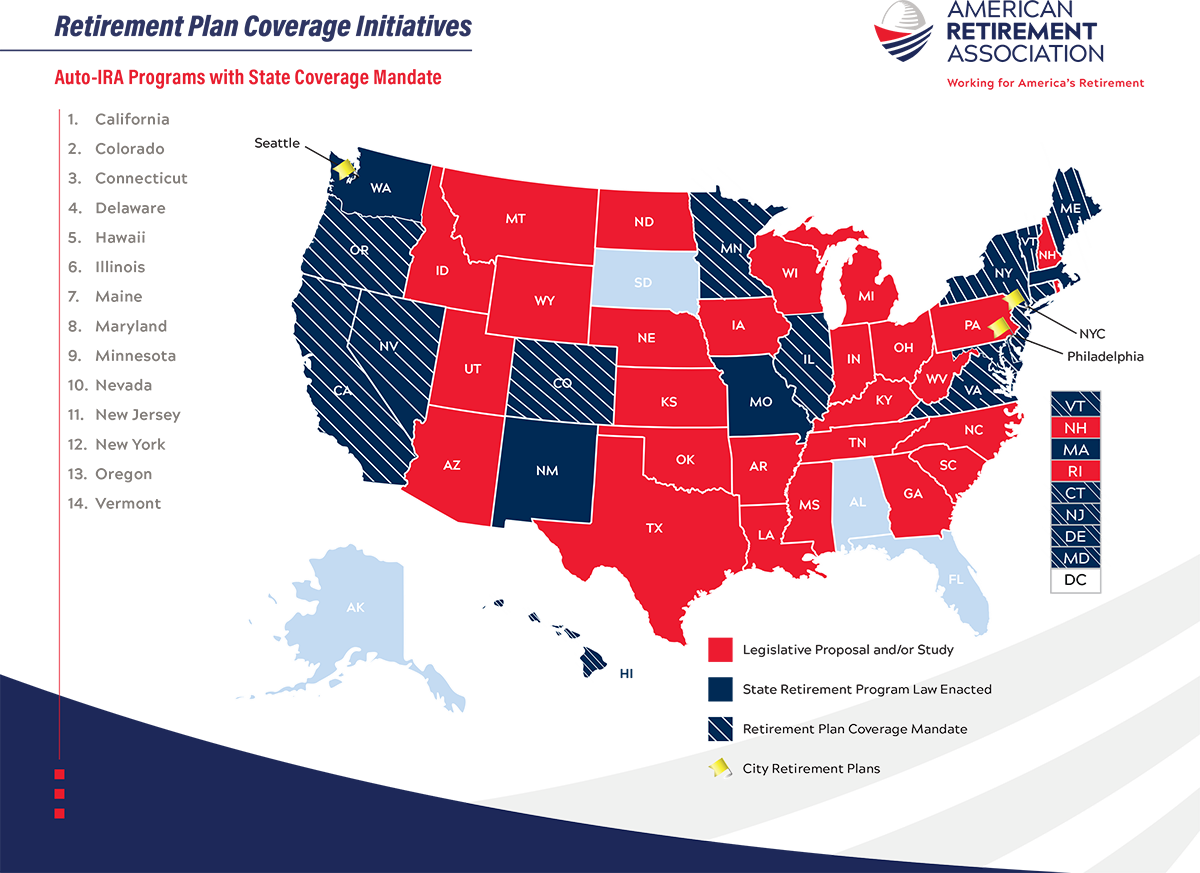

To paraphrase Justice Louis Brandeis, the states “are the laboratories of democracy.” And those laboratories with respect to state-sponsored plans and coverage mandates have multiplied in the last decade. According to the Georgetown Center for Retirement Initiatives (CRI), for eight years running now at least one state per year has enacted a law requiring businesses over a certain size to offer a retirement plan. Just this year, three states – Minnesota, Nevada, and Vermont – enacted new laws with a retirement plan coverage requirement.

State programs created to help businesses meet their new requirements are now operational in seven states: California, Colorado, Connecticut, Illinois, Maryland, Oregon, and Virginia. With so many laws and programs now on the books, there seems to be a development of this new and evolving retirement plan ecosystem on a weekly basis.

To help our members keep track of everything, we at the American Retirement Association (ARA) have put together a comprehensive chart containing key details of each of the fifteen states that have enacted a law with a retirement plan coverage requirement. These details include:

- whether the program is currently operational or still under development

- the employer size threshold at which the retirement plan coverage requirement applies

- the program implementation or employer registration timeline

- an explanation of the types of private sector plans that satisfy the requirement

- links to state-specific websites that provide more details on each particular state program

The ARA remains engaged with like-minded stakeholders in the states that care about addressing the retirement plan coverage gap in the private sector workforce.

The ARA plans to continue to work constructively with any additional states that wish to move forward with a law of their own.

While much progress has been made, there are still way too many states out there that have not yet taken concrete action on this issue. It is our goal to continue to chip away at the problem until access to retirement plans becomes effectively universal in the workforce.

Download our full auto-IRA program analysis here.

Andrew Remo is ARA Director of Federal and State Legislative Affairs.

- Log in to post comments