The challenges, opportunities, and complexities surrounding high-profile SECURE 2.0 provisions were tackled in an Oct. 23 morning session at the 2023 ASPPA Annual conference in National Harbor, Maryland.

The challenges, opportunities, and complexities surrounding high-profile SECURE 2.0 provisions were tackled in an Oct. 23 morning session at the 2023 ASPPA Annual conference in National Harbor, Maryland.

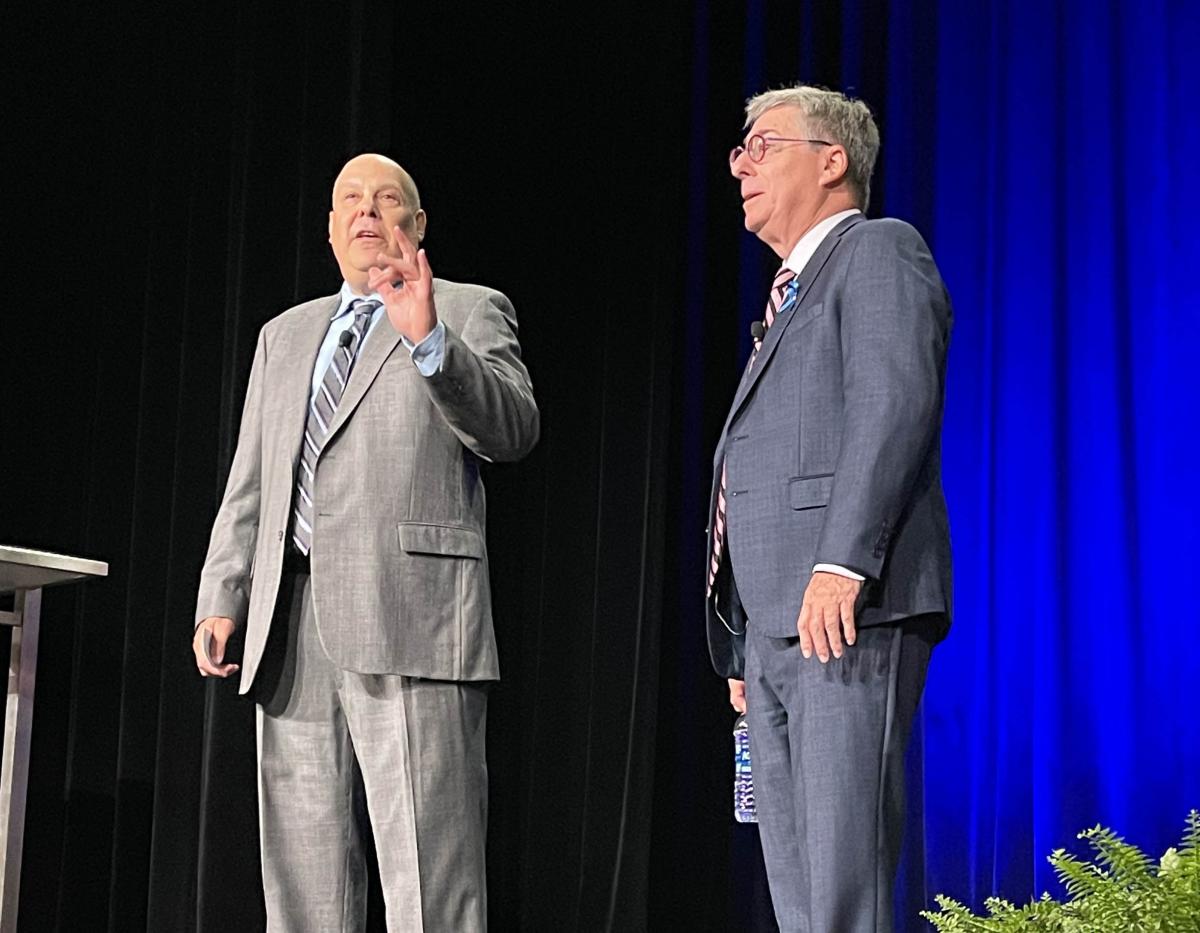

Bob Kaplan, the American Retirement Association's Director of Technical Education, and Robert Richter ARA’s Retirement Education Counsel, kicked it off with a rapid-fire Roth run-through.

Employing Yogi Berra quotes throughout as part of Kaplan’s love for the New York Yankees, topics included:

- the Roth catch-up mandate

- opportunities to utilize tax credits when implementing plans

- required minimum distribution (RMD) changes

- new plan design opportunities

- emergency savings accounts vs. emergency distributions

- changes to distribution rules and taxation

“Rothification is used to raise revenue today in lieu of revenue gained at a later date,” Richter explained. “Changes included in SECURE 2.0 to raise revenue were Roth catch-up contributions and designated Roth employer contributions.”

Other Roth-related revenue changes, he said, are no lifetime RMDs from Roth accounts (RMDs upon death for beneficiaries still exist) as well as distributions from 529 plans to the beneficiary’s Roth IRA.

The catch-up contribution issue for those earning more than $145,000 (they must be designated as Roth), and the fact that the provision is now delayed until 2026 by the IRS in Notice 2023-62, was something that “we were quite frankly surprised at the ARA.”

Richter added that additional guidance will be forthcoming, wondering if payroll and recordkeeping providers will still procrastinate when preparing their processes to accommodate the change.

He then moved to distributions from 529 plans made to a beneficiary’s Roth IRA. 529 plans must have been in existence for 15 years, it has a lifetime limit of $35,000, and the annual limit is the maximum that can be contributed to a Roth IRA.

“The beneficiary must have taxable income to make the contribution (so limits ability to open Roth IRA for young child),” he said.

Kaplan injected humor into a discussion of the long-term part-time employee discussion, somehow comparing it to the Taylor Swift/Travis Kelce relationship and noting it sounded like the title of a country music song.

“SECURE 2.0 lowered the definition of a LTPT employee from three consecutive years to two consecutive years, effective in 2025,” Kaplan said. “There are concerns over the determination of the years of service for vesting for LTPT employees who go to full-time status. There is also concern about whether top-heavy exemption is lost if plan uses immediately eligibility to avoid dealing with LTPT employee determination.”

One decidedly “bad” provision in the good, bad and the ugly of SECURE 2.0 related to disclosures, according to Richter.

“Don’t we have enough disclosures?” he said.

Effective after Dec. 31, 2025, defined contribution plans must provide one paper statement annually unless the participant elects otherwise, and DB plans must provide one paper statement every three years unless the participant elects otherwise.

- Log in to post comments