Having a formal retirement plan can be an asset in a variety of ways, but its value is underappreciated, says a recent study.

A strong majority of retirement investors with an informal retirement plan, and an even bigger majority of those with a formal written retirement plan, express confidence regarding their retirement, says LIMRA in a study of retirement investors ages 40-75 with at least $100,000 in investible assets. But despite the evident benefits of such a plan, less than a quarter of them actually had one.

More specifically, 70% of those with an informal plan said they felt confident about being able to afford the lifestyle they want, and 87% of those with a formal written plan said they do.

These results mirror those Goldman Sachs Asset Management found in a recent study in which 78% of retirees with a retirement financial plan expressed confidence in making the transition from employment to retirement. Further, they found that 79% of those in their study who have a plan said they are on track or even ahead of schedule with their retirement savings.

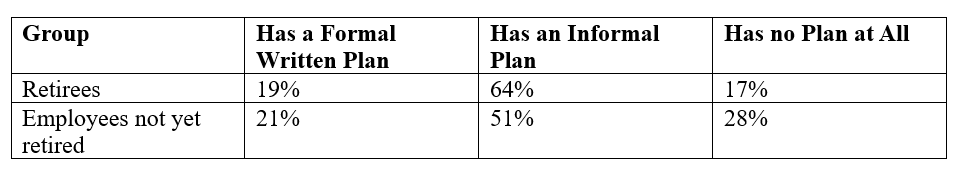

But at the same time, LIMRA says that just around 20% of both groups had a formal written plan. And those figures hold regardless of whether one is a retiree or a future retiree.

Plan Components

LIMRA says that having a formal written plan made it far more likely that an individual would have engaged in a variety of retirement planning activities, including determining income, expenses, and Social Security benefits during retirement; calculating available assets and investments during retirement and estimating how long they will last; determining health coverage, and developing a plan for generating income from retirement savings. And while fewer of those who had only an informal plan had taken action on those factors, still more of them did so than those who had no plan at all.

Increased Interest in Annuities

LIMRA also found that there is heightened interest among those with a formal retirement plan in annuities. They found that 36% of investors with a formal plan had annuities and 27% of those with an informal plan did. LIMRA suggests that increased interest in annuities reflects growing interest in guaranteed income.

About the Study

The figures LIMRA reports come from its 2023 Retirement Investors Survey, in which it talked to 2,831 retirees and 1,669 non-retired workers.

- Log in to post comments