Defined contribution plans are constantly evolving and the number of features plan sponsors can select that encourage employee participation, recruitment and retention, continues to grow. But plan sponsors must balance the desire to offer these incentives and the need to keep the plan manageable and easy to expand.

Think of the plan as a ship: Its owner (plan sponsor) wants to build a bigger and better boat, with features that improve the passenger (participant) experience but without compromising the captain’s ability to steer and maintain the vessel, in both calm and choppy seas (economic conditions).

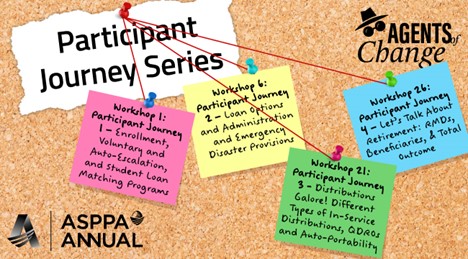

There are so many participant benefits to consider that we’ve developed a four-part “participant journey” we’ll present at ASPPA Annual that explains what plan sponsors and administrators need to know.

During the first leg of the “journey,” we’ll cover:

- voluntary vs. auto-enrollment and auto-escalation, including subsequent savings and re-enrollment and how they affect participation and savings rates

- student loan matches—how they help employees balance their debt repayments and retirement savings and how to determine whether they’ll benefit the company

- long-term part-time (LTPT) coverage

In part 2, we’ll focus on:

- participant loan options, rules and administration, including refinancing, repayment, the pros and cons of offering them, the impact of loan defaults on termination, and strategies for educating employees on loan repayment

- emergency disaster provisions that can be included in plans and the financial support they can provide to employees during times of crisis

- the new $22,000 qualified disaster recovery distribution options and other SECURE 2.0 disaster provisions

In part 3, we’ll examine withdrawal provisions that can help workers cope with unexpected expenses or transitions, including:

- hardship distribution and how they’re affected by SECURE 2.0

- qualified domestic relations orders (QDROs)

- in-service withdrawals

Finally, during the final phase of this “journey,” we’ll examine provisions the SECURE Acts introduced to ensure retireees and their beneficiaries get adequate payments from the plan after they leave the workforce. We’ll explore:

- expanded catch-up contributions

- the new required minimum distribution (RMD) rules

- the growing trend of in-plan retirement income

- SECURE Act changes to mortality tables and their effects on disbursement amounts and associated beneficiary distribution issues

By taking this journey with us at ASPPA Annual, you’ll learn how these changes could improve outcomes for retirees, how they’ll affect participants, sponsors and administrators and what needs to be communicated to plan sponsors.

- Log in to post comments