The Pension Benefit Guaranty Corporation (PBGC) has updated the instructions for filing premiums as well as the portal through which they can be filed.

Rules Are Rules

Sections 4006 and 4007 of ERISA and the PBGC’s Premium Regulations require that premiums be paid to the PBGC; every plan covered under ERISA Section 4021 must make an annual premium filing. Most private-sector defined benefit plans that meet tax qualification requirements are covered.

There are two kinds of annual premiums: (1) flat-rate premiums, which apply to all plans, and (2) variable-rate premiums (VRPs), which apply only to single-employer plans.

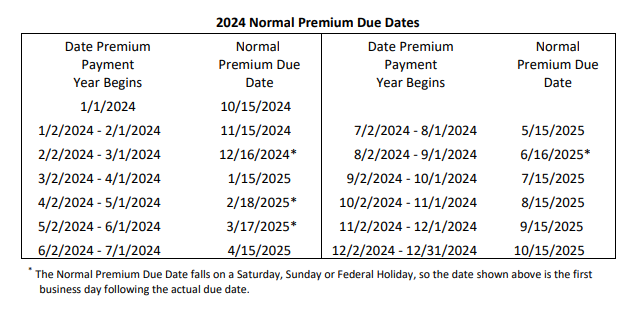

In most cases, premium filings are due on the normal premium due date, (i.e., the 15th day of the 10th full calendar month in the plan year). If that date falls on a Saturday, Sunday or federal holiday, the due date is automatically extended to the next business day.

2024 Premium Filing Instructions

The PBGC has issued the Comprehensive Premium Filing Instructions for 2024 Plan Years. These instructions provide information for plans paying premiums for plan years beginning in 2024, including instructions for each data element that must be reported.

The filing requirements for 2024 are almost identical to those for 2023; however, there are some changes for 2024 that are worthy of note.

Premium rates. Following are changes in premium rates.

For single-employer plans other than CSEC plans:

- the flat-rate premium is $101 per-participant, up from $96; and

- the cap on the variable-rate premium is $686 per person, up from $652.

Because legislation enacted in 2022 eliminated indexing on the variable rate premium rate, the 2023 rate of $52 per $1,000 of unfunded vested benefits remains unchanged.

For multiemployer plans, the flat-rate premium is $37 per participant, up from $35; multiemployer plans do not pay variable-rate premiums.

Premium rates for CSEC plans are not indexed, and thus those rates have not changed.

Customer service email. The premium customer service email address has changed from [email protected] to [email protected]. Emails sent to the old address will be forwarded to the new mailbox.

Filing

Electronic filing is mandatory for all plans.

Premium filings are submitted electronically through PBGC’s e-filing application, My Plan Administration Account (My PAA).

Filings may be prepared in two ways: (1) directly through My PAA, and (2) through approved private-sector software, which then are uploaded My PAA.

Changes Coming to the PBGC e-Filing Portal

The PBGC on Jan. 8 announced that on Feb. 1, 2024, it will launch a new and improved e-Filing Portal. Key changes include a new, more secure, login process and a streamlined look and feel across all applications.

Beginning that date, the only way to access the PBGC’s e-Filing Portal will be via Login.gov. The PBGC is doing so in accordance with Executive Order 14028, which requires federal agencies to adopt multifactor authentication for public-facing websites. Login.gov uses two-factor authentication and password requirements for secure validation and verification, which satisfies this requirement. The PBGC began to comply in 2023 by making these changes to My PAA, and is now completing the transition by making the same change to its e-Filing portal.

What this means. Filers will need to set up a Login.gov account and use their credentials to log in to the e-Filing Portal instead of using their current e-Filing portal login credentials.

- Log in to post comments