The Pension Benefit Guaranty Corporation (PBGC) on Sept. 12 issued the interest assumptions under the asset allocation regulation for plans with valuation dates in the fourth quarter of 2023.

The assumptions are contained in a final rule that amends the PBGC’s regulation on Allocation of Assets in Single-Employer Plans. These interest assumptions are used for valuing benefits under terminating single-employer plans and for other purposes.

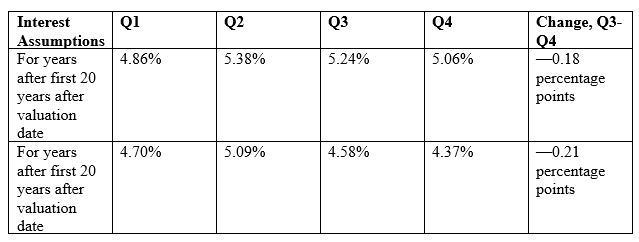

The assumptions. The fourth quarter 2023 interest assumptions will be 5.24% for the first 20 years following the valuation date and 4.37% thereafter.

Compared to the interest assumptions in effect for the second quarter of 2023, these interest assumptions represent no change in the select period (the period during which the select rate (the initial rate) applies), a decrease of 0.18 percentage points in the select rate, and a drop of 0.19 percentage points in the ultimate rate (the final rate).

The use of the assumptions. The PBGC uses the interest assumptions in Appendix B to Part 4044 to determine the present value of annuities in an involuntary or distress termination of a single-employer plan under the asset allocation regulation. The assumptions are also used to determine the value of multiemployer plan benefits and certain assets when a plan.

Effective date. These interest rate assumptions will be effective Oct. 1, 2023.

Finding Out More

The interest rate assumptions appear in the Federal Register of Sept. 13, 2023.

- Log in to post comments