The Pension Benefit Guaranty Corporation (PBGC) has issued a final rule adjusting for 2024 the civil penalties for failure to provide certain notices or other material information and for failure to provide certain multiemployer plan notices. The PBGC is required to amend its regulations annually to adjust those penalties for inflation.

The rule adjusts the maximum civil penalties that the PBGC may assess under Sections 4071 and 4302 of ERISA.

Title IV of ERISA, which the PBGC administers, has two provisions that authorize PBGC to assess civil monetary penalties: (1) Section 4302, which, authorizes the PBGC to assess a civil penalty of up to $100 a day for failure to provide a notice under subtitle E of Title IV of ERISA, and (2) Section 4071, which authorizes the PBGC to assess a civil penalty of up to $1,000 a day for failure to provide a notice or other material information under subtitles A, B, and C of Title IV and Sections 303(k)(4) and 306(g)(4) of Title I of ERISA.

On Dec. 19, 2023, the Office of Management and Budget issued memorandum M–24–07 on implementation of the 2024 annual inflation adjustment. It provides agencies with the cost-of-living adjustment multiplier for 2024, which is based on the Consumer Price Index (CPI–U) for October 2023 and is not seasonally adjusted. The multiplier for 2024 is 1.03241.

The Rates

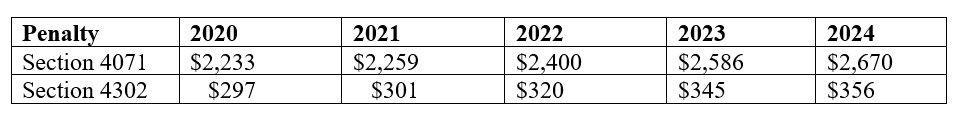

The new maximum amounts for 2024 are:

- $2,670 for Section 4071 penalties; and

- $356 for Section 4302 penalties.

Both penalties are higher than those announced in 2023. Following are the rates since 2020:

Penalties

Penalty

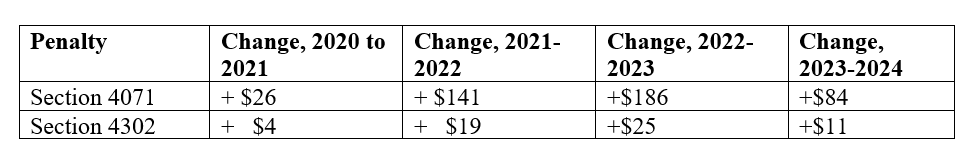

The penalties increased from the previous year, but at less than half the pace as they did from 2022 to 2023.

Year-to-Year Change in Penalty

Penalty

This rule became effective Jan. 12, 2024. The increases in the civil monetary penalties apply to such penalties assessed after that date.

- Log in to post comments