The Pension Benefit Guaranty Corporation (PBGC) has updated its Pension Insurance Data Tables concerning its Single-Employer and Multiemployer Programs. Overall, there is good news in the new figures.

The tables summarize information on PBGC’s Single-Employer and Multiemployer Insurance Programs. Information from PBGC operational data is for the 2022 fiscal year.

Highlights of the information include the following.

Single-Employer Program

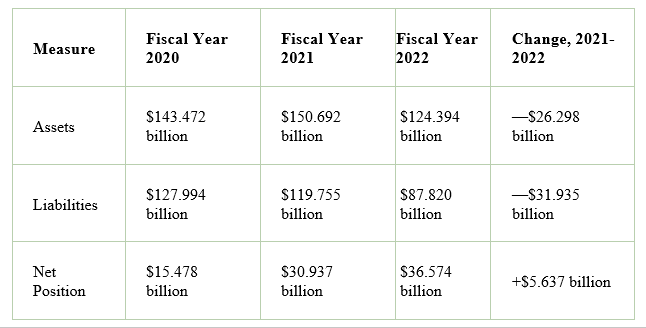

The assets in the PBGC’s Single-Employer Program in FY 2022 were lower than those in FY 2021; the drop from 2021 to 2022 was sharp enough that the 2022 figure is even below that of FY 2020.

At the same time, however, liabilities for the FY 2022 dropped even more sharply than assets from FY 2021, bolstering the drop that occurred from 2020 to 2021.

The overall result for FY 2022 still was positive: a net gain of more than $36 billion, and a net change from 2021 to 2022 of more than $5 billion.

Assets and Liabilities, Single-Employer Program, 2020-2022

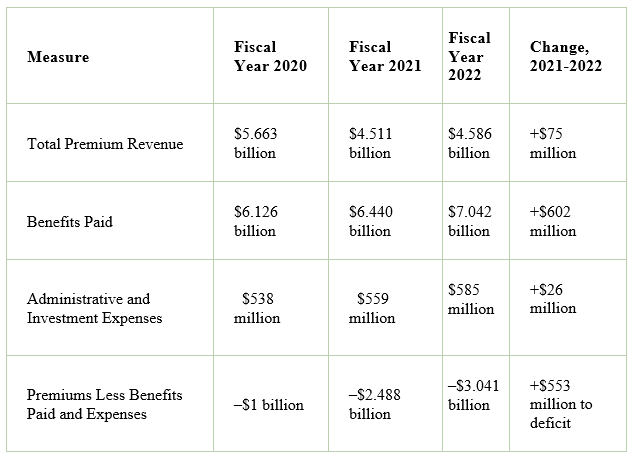

Premiums and Benefits. The PBGC continues to pay more in benefits than it brings in from premiums, the report shows.

In FY 2022, the deficit was higher than that of 2021; however, it did not grow as much as it did from 2020 to 2021.

Trends in Single-Employer Program Premiums and Benefits, 2020-2022

Claims. The PBGC reports that in 2022, there were claims on the single-employer program of $154,698,255. Almost half — 48.5% — were from the top 10 firms from which claims were made: United Airlines, Delphi, Bethlehem Steel, US Airways, LTV Steel, Delta Air Lines, National Steel, Sears Holdings, McClatchy Co., and Avaya.

Multiemployer Program

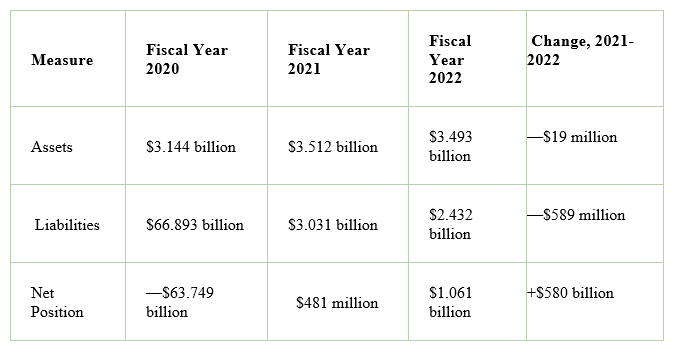

The PBGC reports that the fortunes of its Multiemployer Program continue to improve: it was underwater in 2020, but had a positive net position in 2021; that continued in 2022.

Multiemployer Program Assets and Liabilities, 2020-2022

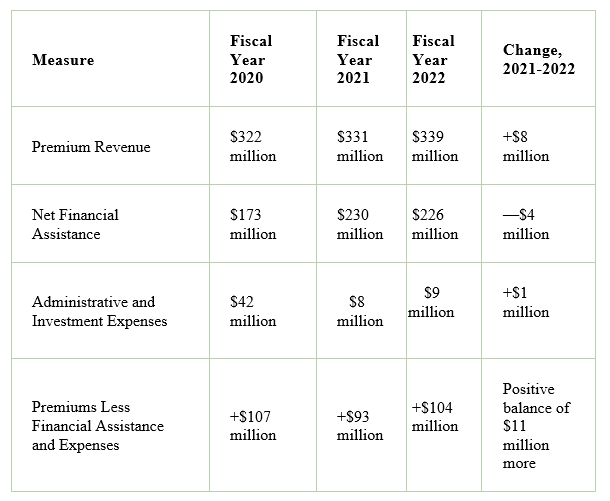

And still more good news. Premiums rose by virtually the same amount from 2021 to 2022 as they did from 2020 to 2021, but the program provided $4 million less in net financial assistance in 2022 than it did in 2021—a total reversal of the sharp increase in assistance from 2020 to 2021. Administrative and investment expenses rose from 2021 to 2022, but only by $1 million.

The overall result was the for FY 2022, the net balance continued to be positive, and was $11 million better than it was in FY 2021.

Trends in Multiemployer Program Premiums and Benefits, 2020-2022

- Log in to post comments