More good news on (closing) the retirement plan coverage gap, specifically related to state auto-IRA mandates.

The American Retirement Association has long argued—and an increasing body of research confirms—that state-sponsored retirement plans close the coverage gap, not only by providing a public option, but by encouraging higher private plan adoption, as well.

What’s more, the largest adoption gains are seen in lower-income workers, those most negatively impacted by the lack of plan coverage.

Digital HR platform Gusto is the latest firm to release relevant research. Its Government Affairs and Economic Research teams found that:

State auto-IRA mandates drive 401(k) adoption amongst the smallest employers and analyzed Colorado and Oregon specifically.

- The increase in firm 401(k) adoption translates into higher employee enrollment rates, with the greatest boost among the lowest-earning employees.

- The smallest businesses have seen the largest boost in retirement coverage.

- The requirement that firms offer a retirement plan not only increases firm participation but also likely improves employee financial security.

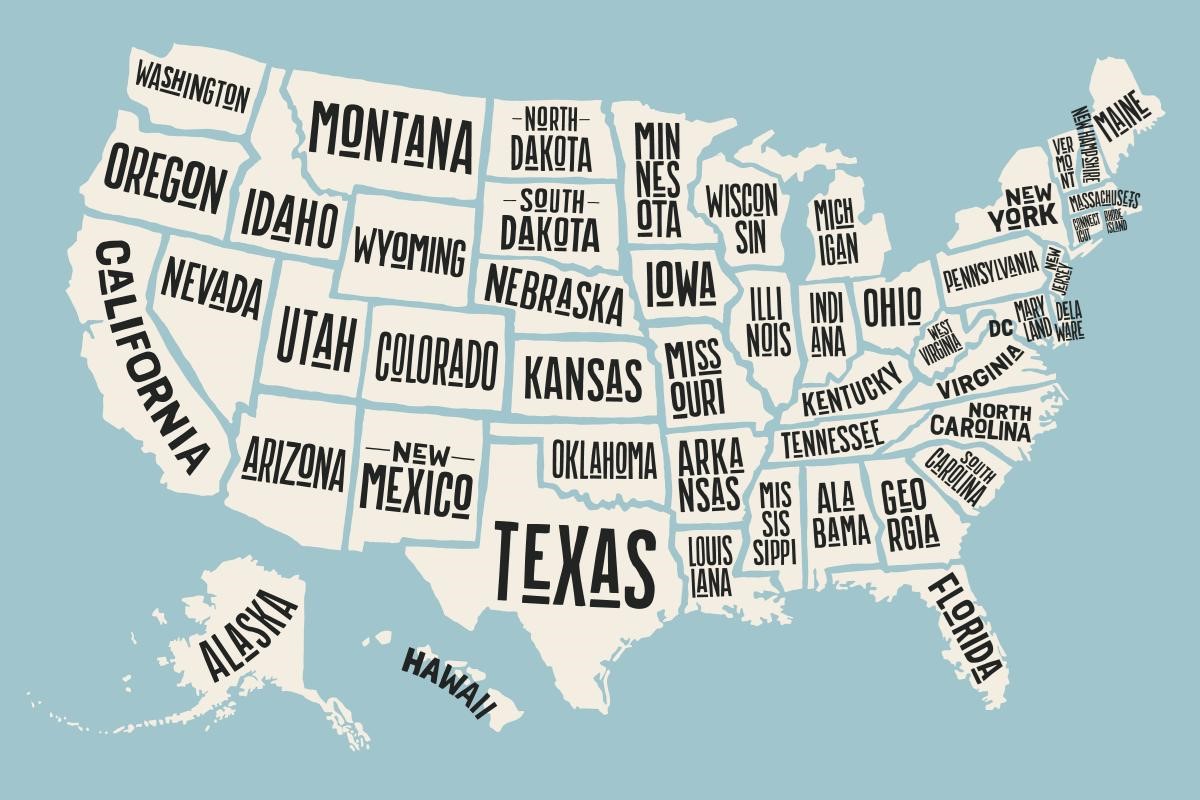

“From one year before [Colorado’s] mandate went into effect in July 2022 through August 2023, the share of [companies with five employees or more] in Colorado that offer a 401(k) plan increased 45% (or 13 percentage points), from 25.3% to 38%,” Gusto said. “In neighboring states that do not have such a requirement (Arizona, Utah, Nevada, Kansas, and Nebraska), the share remained nearly flat, increasing from 20.4% to 21.2%.”

In Oregon, firms with five or more employees were already subject to a mandate, so Gusto looked at firms with between one and four employees in that state and neighboring Washington.

“In Oregon, the share of firms with 1–4 employees offering a 401(k) plan has risen from 7% to 11% from January 2023 to August 2023, while the share of firms in neighboring Washington ticked up much more slowly, from 7.7% to 8.6%,” it said.

And don’t forget the benefits to business owners of offering a plan.

Gusto noted that offering employees a 401(k) can reduce employee attrition by 40% on average over one year.

“Thus, as the recognition of the importance of financial benefits continues to grow, firms still have an opportunity to differentiate themselves in the competitive job market by helping employees participate in these no-cost or low-cost retirement programs.”

- Log in to post comments