Like trees whose green leaves are mixed with the first ones brushed by Autumn’s paintbox, the results for private-sector pension plans were mixed in September.

By a variety of measures, September was a pushmi-pullyu for DB plans, according to several analyses. Liabilities down, funded status up, assets down.

Funded Status

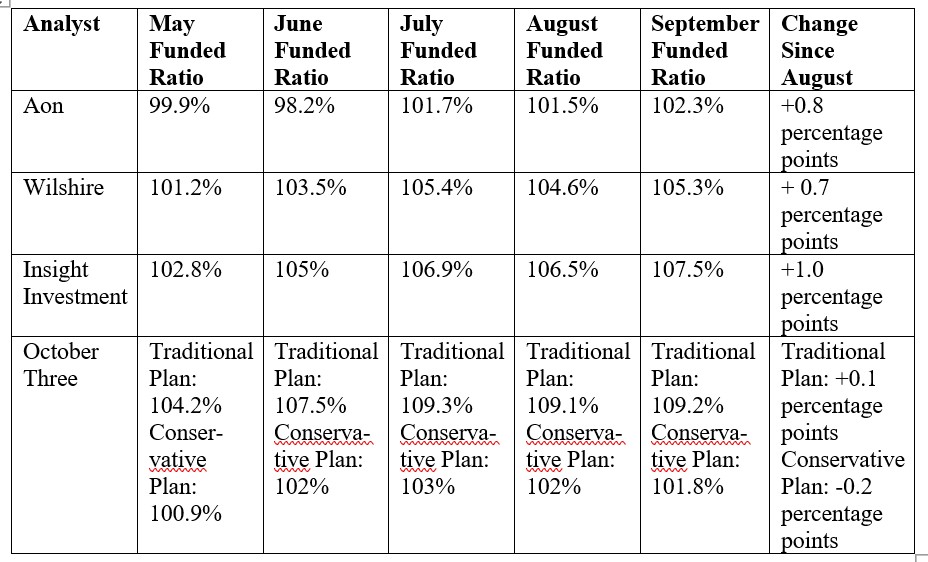

The funded status for private-sector DB plans improved slightly in September, according to Aon, Insight Investment, Wilshire Associates, and October Three.

Assets

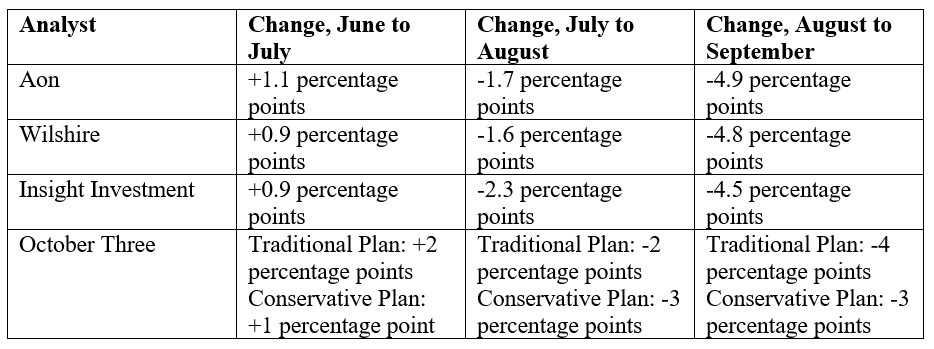

All four reported that assets in September dropped, continuing the trend that started after the end of July. Further, all four reported roughly the same drop in asset levels, almost 5 percentage points.

Liabilities

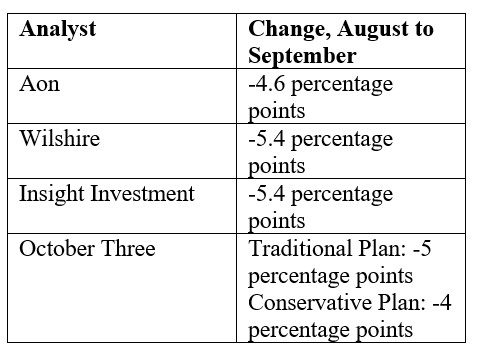

While assets fell in September for private pension plans by the reckoning of all four analysts, so did liabilities. In fact, pension liabilities fell by a greater degree than did assets.

The Bigger Picture

The results in September may have been mixed, but the overall trends for 2023 still are positive, according to Aon and Wilshire.

Aon observes that for 2023 through Sept. 30, the Standard & Poors 500 aggregate funded ratio has increased by 4.1 percentage points.

Wilshire, for its part, says that the September 2023 funded ratio of 105.3% is the highest they have recorded since December 2012. In fact, says Wilshire Managing Director Ned McGuire in a press release, the September funding ratio “is approaching the funded ratio of 107.8% before the Great Financial Crisis.”

- Log in to post comments