Those lazy, hazy, days of summer lived up to their name this year: Private-sector pension plans showed only slight changes in status in August by a range of measures, according to multiple reports.

Funded Status

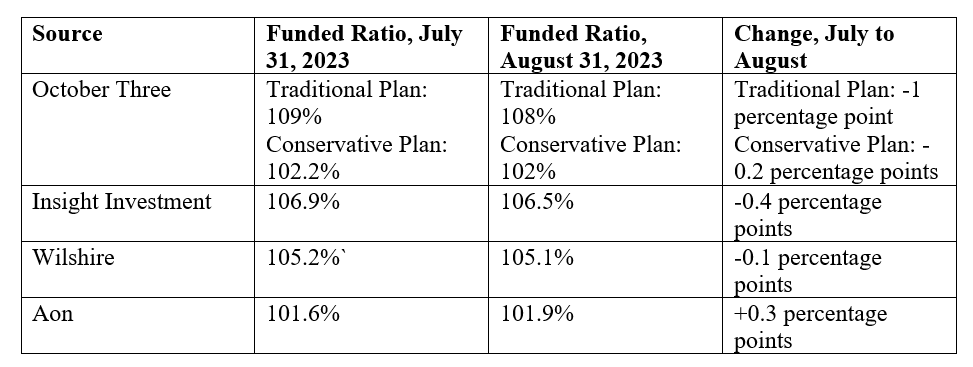

Funded ratios for private-sector defined benefit plans showed slight changes from July 31 to Aug. 31, analysts say:

Assets

Assets

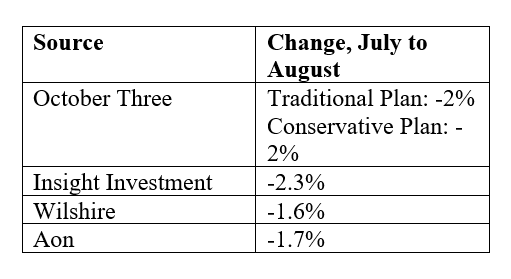

Like funded status, assets held by private-sector DB plans slipped slightly in August as well.

Insight Investment also reports that asset returns fell in August, and were 1.6% lower at the end of the month than they were when August began.

Liabilities

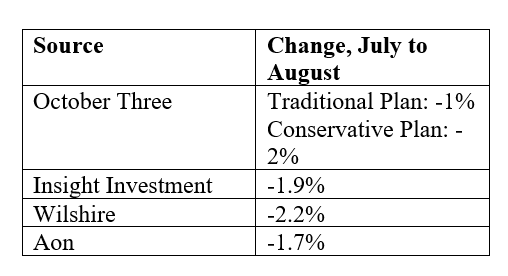

While assets fell in August, so did liabilities.

October Three attributes the August liabilities figures to the strong corporate bond yields it found last month.

But STILL Some Good News

Despite the lackluster August results, overall for 2023 private-sector pension plans still are doing better than they were as 2022 ended, say the analysts.

Aon’s Pension Risk Tracker reports that the funded ratio for U.S. pension plans run by S&P 500 employers has improved overall for the year by more than 3 percentage points. They attribute that to asset growth of $15 billion and a $36 billion drop in liabilities.

Other analysts report even stronger results for the year to date. Wilshire says the funded ratio rate on Aug. 31 is 6.3 percentage points higher than that on Jan. 1. For its part, October Three says for the traditional plan it tracks the funded status now is 8% higher than it was at the start of 2023, and the conservative plan is up 2%.

- Log in to post comments