Health issues can arise at any time. And during retirement, many may turn to their 401(k) for the funds to address them—but health savings accounts (HSAs) are another option, and a July 27 webinar took a look.

Sara Caddy, Benefits Manager and Vice President at Dimensional Fund Advisors, and Tara Kahler, Human Resources Manager at Whiteford, Taylor & Preston, shared their perspectives in the Plan Sponsor Council of America (PSCA) webinar. Both are members of the PSCA HSA Committee, which is led by Karin Rettger, President of the Principal Resource Group, who served as moderator.

Setting the Table

“Emergencies are going to happen to you,” said Kahler. Caddy suggested that the need for funds to cover such matters can be broader than just one incident, remarking, “I don’t think people realize how much money will be spent on health care during their retirement years.” In addition, Kahler pointed out, Medicare—a coverage option for many—isn’t free, despite the common assumption that it is. “Many people are caught off guard by Medicare costs,” she said.

Some 401(k) participants take hardship withdrawals or loans to cover the costs of medical care. Not only does doing so reduce the size of one’s 401(k), Caddy and Kahler point out, it also has other consequences. Among them:

- the loans can set a participant back in saving for retirement;

- hardship withdrawals are subject to income tax on any untaxed funds, as well as penalties if the person taking the withdrawal is younger than age 59½;

- borrowed funds do not earn investment returns; and

- borrowed funds must be repaid.

How much will that be? Panelists cited statistics showing that a 65-year old who retires in 2023 can expect to spend $157,5000 on health care during retirement.

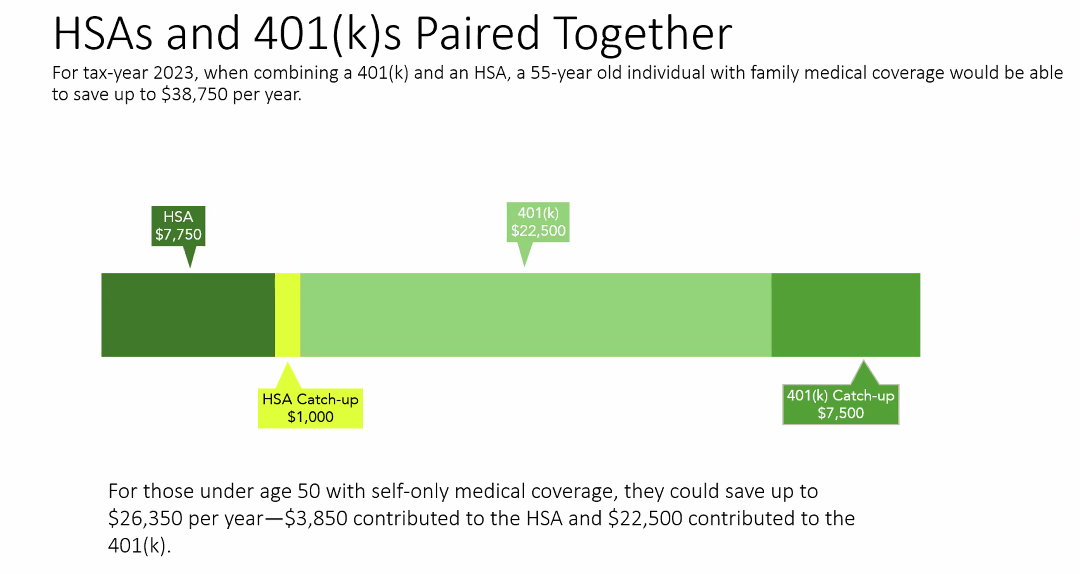

They further cited statistics saying that for tax year 2023, a 55-year old with family health coverage could save up to $38,750 per year if he or she combines a 401(k) and an HSA.

Enter HSAs

HSAs are a savings vehicle that can supplement a retirement plan, observed Caddy. She added that 401(k)s are a great savings vehicle, but HSAs are ideal for health care expenses in retirement. And part of the reason for that, she said, is the triple tax advantage that HSAs offer, which gives them an advantage over 401(k)s—whose distributions are taxed—for use in paying for health care.

Kahler elaborated on that advantage, observing that HSA distributions are not taxed on contributions to them, nor on earnings on investments made with their funds and from interest on the accounts, nor on withdrawals.

Kahler also pointed out that HSAs belong to an employee and not an employer, are portable, and are not subject to vesting.

And since an HSA can be drawn upon to help cover health-related expenses during retirement, said, Kahler, “it is considered a retirement vehicle.” In addition, she suggested that HSAs can help preserve balances in other retirement accounts, remarking that HSAs help reduce the number of hardship withdrawals that might otherwise be taken from a 401(k) or other account if an emergency occurs.

Coordinating HSAs and 401(k)s

Kahler and Caddy offered some ideas on strategies by which HSAs and 401(k)s can be coordinated.

They offered an illustration of the savings that can result from pairing HSAs and 401(k)s:

Kahler and Caddy suggest that employers and plan administrators communicate to employees and HSA holders that HSAs are not just part of health coverage, but can be a part of a retirement strategy.

Caddy and Kahler argue that it is important to emphasize with employees that they should:

- Make sure that their HSAs are funded. “HSA plans are not considered active until they are funded,” Caddy remarked.

- Not leave free money on the table, by (1) making sufficient contributions to a 401(k) account that will make them eligible for an employer match; (2) making the biggest contributions they can to their HSAs; and (3) continuing to contribute to a 401(k).

- Remember that they have an opportunity to make investments through an HSA.

- Try to limit HSA withdrawals so the funds are available for future medical expenses and/or medical emergencies.

- Try to avoid withdrawals from their 401(k)s to cover medical expenses.

The Bottom Line

There is “one less thing to worry about if we have an HSA to dip into,” remarked Kahler.

- Log in to post comments