Any retirement fund invests its funds in some way to help them grow, and that includes those run by states. A look at how CalSavers handles the investment of its funds sheds some light on how one of the largest state-run retirement plans fosters growth of their funds.

Assets

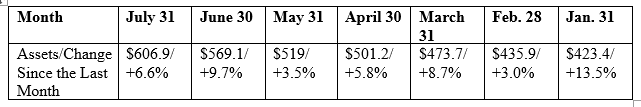

CalSavers had assets of just over $600 million by July 31, 2023. Its assets showed 6.6% growth since June 30, and have been steadily growing. Here’s a look at CalSavers assets month-to month in 2023 (in millions of dollars):

In July, those assets included contributions of just over $702 million from 437,586 funded accounts whose holders worked at 117,850 registered employers.

Oversight

The CalSavers Retirement Savings Board administers CalSavers and exercises oversight over the program—and, of course, its assets and how they are invested.

In doing so, the board seeks the assistance of outside service providers. The current service provider that assists the board in managing investments of CalSavers funds is Meketa Investment Consultants.

Request for Proposals

On Sept. 5, the board issued an RFP (request for proposals) announcing that it is seeking an outside consultant to help it exercise oversight by providing investment consulting services.

Christian Daly, External Affairs Manager in the office of California State Treasurer Fiona Ma, told ASPPA Connect, “The CalSavers Retirement Savings Board determined that having a qualified outside consultant benefits the members of the CalSavers program and assists in fulfilling their fiduciary obligation to participants of CalSavers and their beneficiaries.”

More specifically, says Daly, “A qualified consultant is needed to assist the board with an annual review of the program’s investment policy statement, work collaboratively within and across the organizations and teams that are, or will become, service providers to and stakeholders in the program, and monitor the performance of the investment manager(s) and the investment options included in the program.”

The vendor selected will provide services for 30 months, with an option to extend an additional year.

What the Board Is Looking for

The RFP spells out in great detail what the board is looking for in a vendor that will help them with CalSavers investments.

Vendor Duties. The outside consultant will be responsible for the following:

- Under the direction of the board or the Executive Director, analyze and evaluate asset allocation and investment options for the trust based upon investment objectives established by the board, expected use of the accounts, and the role of risk reduction.

- Facilitate an annual review of the board’s investment policy statement, including investment beliefs.

- Consistent with the investment policy statement, advise the board on, and support the review of, an ongoing risk management and oversight program.

- Participate in the development of the investment manager request for proposals, if needed, and assist the board with evaluation of the proposals.

- Advise the board regarding which data should be reported quarterly by the investment manager(s).

- Periodically compare program fees to those of other state-sponsored retirement plans.

- Conduct monthly investment performance monitoring and (1) provide quarterly evaluations of the trust that compare investment results to appropriate indices and board policies, including compliance by the investment manager(s) to these policies, and (2) provide evaluations to the board or its designee within 10 business days of receiving the data from the investment manager(s).

- Provide or recommend investment-related educational sessions for board members, as requested, no more than twice per year.

- Inform the board and Executive Director in the event of significant changes in the investment climate or market conditions that could affect trust investments.

- Provide general advice, counsel, and recommendations on a variety of investment-related matters regarding the trust, including investment personnel, investment strategy, investment option design or modifications, the overall qualitative position of investment manager(s), other state-sponsored retirement program vendors, and issues and trends relevant to the state-sponsored retirement industry.

- Collaborate and communicate with consultants, record keepers, investment managers and other parties retained by the board, as needed.

- Attend all board meetings unless it notifies the vendor otherwise.

- Be available to consult with board members and the Executive Director during their business hours.

- Respond to the need for telephone consultation within a 24-hour period and be available for meetings with the board with no greater than 10 days’ notice.

Qualifications. In the RFP, the board says that the vendor it is seeking to handle the investment of CalSavers funds must:

- have been actively providing advice on retirement plan investment options for at least the last five years;

- have investment expertise that includes knowledge and experience in a wide range of investment vehicles;

- have at least three years of experience providing investment consulting services to state-sponsored savings plans (e.g., 529, ABLE, or Secure Choice savings plans);

- have been providing consultation to, or on behalf of, individuals or governmental agencies that have been investing funds totaling at least $1 billion;

- agree in writing to serve as fiduciary to the trust solely in the interest of the program participants;

- agree that during the term of a contract it will not—without board approval—have a contractual or other business relationship with any program management or administrative services contractor that provides services for the trust or any investment manager directing funds in the program, either on its own or in partnership with other entities;

- be qualified to do business in the State of California; and

- if awarded the contract, be able to provide evidence of qualification to do business in the State of California from the California Secretary of State, as well as for any subcontractor identified as personnel.

Deadline

The board will accept proposals through 4:00 p.m. PDT on Oct. 6, 2023.

The board plans to evaluate the proposals it receives during the period Oct. 9-27. It expects to issue a notice of intent to award the contract on Nov. 13, and plans that the contract with the outside vendor will go into effect on Jan. 10, 2024.

- Log in to post comments