ASEA Monthly

Natural disasters disrupt normal business activity. The IRS makes timely notice to taxpayers of areas eligible for relief after disasters such as Hurricane Idalia and other recent events (see sidebar). Herein, we trace some of the regulatory language and published guidance from the IRS on disasters and their effect on pension funding.

Defined contribution plans generally have extended periods to comply with disruptions, but defined benefit (including cash balance) plans have additional constraints.

Who Is Affected by This?

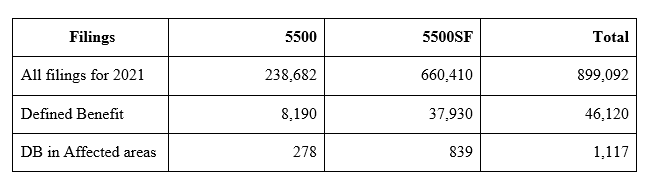

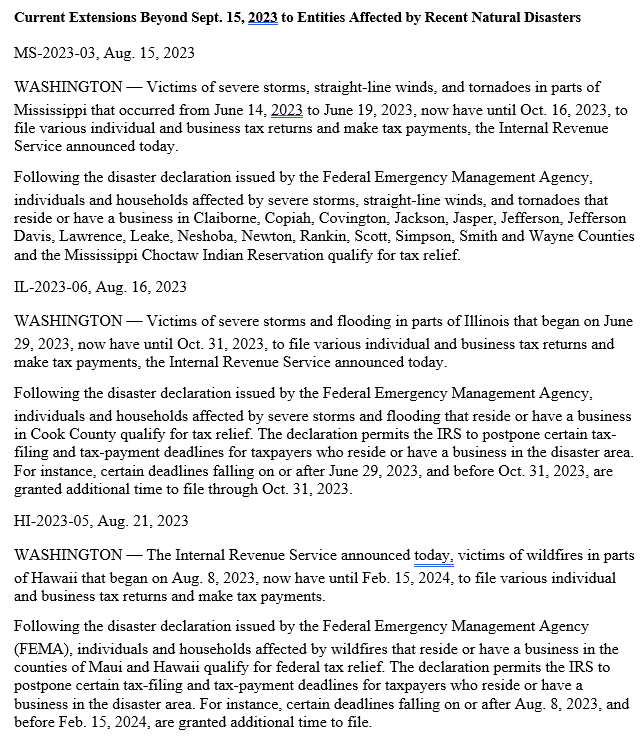

The posted disaster notices are shown at the end of this note. Locations in Mississippi, Illinois, and Hawaii were noted by county, and plans in those affected areas were selected by their postal zip code.

From the available data in the EBSA database, we can trace the approximate number of plans that potentially are affected among filers of Forms 5500 and 5500SF. No available database of 5500EZ filers is available; that is outside the scope of this discussion, although there should be substantial numbers affected in those plans. The most recent filings from 2021 were examined to indicate possible candidates for extended disaster relief.

It is reasonable to expect substantially more will become eligible from due to the effects of Hurricane Idalia in populated areas of Florida, Georgia, and South Carolina.

There will be individual determinations of which plans the disaster actually affected, recognizing that plans could be affected if the plan sponsor, trustees, recordkeepers, TPAs, accountants, and actuaries are in an affected area and unable to service the plans highlighted above. Only the IRS will be able to compile their actual number of plans qualifying for relief. Collecting the documentation of problems caused by disasters is very helpful. If external vendors are causing delays, they would need to document their issues as well.

To put the issue in a regulatory perspective, here are selections from relevant IRS information.

Regulation 301.7508A-1. discusses the authority and remedy offered for disaster declarations.

It references that qualified plans may extend time to deduct retirement plan costs.

(g) Mandatory 60-day postponement—(1) In general. In addition to (or concurrent with) the postponement period specified by the Secretary in an exercise of the authority under section 7508A(a) to postpone time-sensitive acts by reason of a federally declared disaster, qualified taxpayers (as defined in section 7508A(d)(2)) are entitled to a mandatory 60-day postponement period during which the time to perform those time-sensitive acts is disregarded in the same manner as under section 7508A(a). The rules of this paragraph (g)(1) apply with respect to a postponement period specified by the Secretary under section 7508A(b), to postpone acts as provided in section 7508A(d)(4). Except for the acts set forth in paragraph (g)(2) of this section, section 7508A(d) does not apply to postpone any acts.

(2) Acts postponed. The time-sensitive acts that are postponed for the mandatory 60-day postponement period are the acts determined to be postponed by the Secretary's exercise of authority under section 7508A(a) or (b). In addition, in the case of any person described in section 7508A(b), the time-sensitive acts postponed for the mandatory 60-day postponement period include those described in section 7508A(d)(4):

(i) Making contributions to a qualified retirement plan (within the meaning of section 4974(c)) under section 219(f)(3), 404(a)(6), 404(h)(1)(B), or 404(m)(2); …

404(a)(6) Time when contributions deemed made

For purposes of paragraphs (1), (2), and (3), a taxpayer shall be deemed to have made a payment on the last day of the preceding taxable year if the payment is on account of such taxable year and is made not later than the time prescribed by law for filing the return for such taxable year (including extensions thereof).

4974(c) Qualified retirement plan

(1) a plan described in section 401(a) which includes a trust exempt from tax under section 501(a), (This includes DB plans by the plain reading of the text.)

(2) an annuity plan described in section 403(a),

(3) an annuity contract described in section 403(b),

(4) an individual retirement account described in section 408(a), or

(5) an individual retirement annuity described in section 408(b).

Such term includes any plan, contract, account, or annuity which, at any time, has been determined by the Secretary to be such a plan, contract, account, or annuity.

Notice 2017-49. The IRS has given specific disaster relief in the past, including Notice 2017-49 for Hurricanes Harvey and Irma. This notice does reference Internal Revenue Code (IRC) Section 412(c )(5) for waiving funding, which has a 2½-month deadline that would be impossible to follow, since the disaster often occurs during the period of preparing returns or making deductible contributions while on tax filing extension.

Rev. Proc. 2018-58. Rev. Proc. 2018-58 guidance discusses generic issues when disasters are declared, primarily focused on the armed forces, but also mentioning many other tax issues. However, contribution timing is not directly addressed for IRC Section 430. It also limits relief solely to hardships of the taxpayer, even though a late filing might be caused by a vendor’s hardship.

Notice 2020-61. Notice 2020-61 concerned the distress COVID-19 created, and it gave extensive relief for that specific crisis, including from IRC Section 430(i) deadlines. It would serve as a pattern for similar future disasters if the IRS chose to publish such guidance.

But What About DB Plans?

However, plan sponsors do not have automatic approval to delay compliance with IRC Section 430, and the 8½-month deadline for minimum funding. Thus, a plan can deduct their contribution to the retirement plan if made by the extended due date; however, they would not comply with the timing for IRC Section 412 /430 rules. This would leave the plan sponsor exposed to excise tax under IRC Section 4971(c)(4).

Special guidance was offered in Notice 2020-61 for delays caused by Covid under the CARES Act. No such guidance nor automatic extension is currently in force for plans affected by federally declared disasters. So a plan administrator affected by a disaster would have deductible contributions made after the normal funding deadline and face no tax penalty for their deduction, but they would still face excise tax for the “late” contribution. Further, they would need to comply with requirements to notify the Pension Benefit Guaranty Corporation (PBGC) and Department of Labor.

This leaves the plan sponsor and the actuary certifying compliance with IRC Section 430 with a choice.

- If the plan sponsor determines that the late contributions after 8 ½ months are covered by the guidance, they can request the actuary to include the contributions on their certification, and to note that the filing is not in conformity with current 430 regulations.

- Alternatively, the plan sponsor can file the certification ignoring late contributions, potentially creating a funding deficit, and attach explanation in their 5500 or 5330 filing that they request a waiver of excise taxes due to the disaster.

A more desirable goal is that the IRS modify 301.7508A-1 to also provide a reference to IRC Section 430. This would require a policy change and would ideally include the logic found in Notice 2020-61.

It is time to consider how we deal with this recurring issue for the victims, both current and future.

Robert R. Mitchell, MSEA, is an enrolled actuary.

Sidebar

- Log in to post comments