In an Oct. 24 morning session titled “Charting a New Course: Navigating Roth Changes in the Post SECURE 2.0 World” with ‘secret agent’ Shannon Edwards with TriStar Pension Consulting and Michelle Ueding, an employee benefits and executive compensation attorney with Kutak Rock, focused on all one needs to know about after-tax contributions.

In an Oct. 24 morning session titled “Charting a New Course: Navigating Roth Changes in the Post SECURE 2.0 World” with ‘secret agent’ Shannon Edwards with TriStar Pension Consulting and Michelle Ueding, an employee benefits and executive compensation attorney with Kutak Rock, focused on all one needs to know about after-tax contributions.

More specifically, the presentation at ASPPA Annual in National Habor, MD, covered SECURE 2.0 Sections 603, Roth Catch-up; 325, Roth Required Minimum Distributions; 604, Roth Employer Contributions; and 127, Pension Linked Emergency Savings Accounts.

So, what changed with the Roth catch-up contributions?

Internal Revenue Code (IRC) Section 414(v) was amended to prohibit certain participants from making pre-tax catch-up contributions. The effective date was listed as calendar years beginning after Dece. 31, 2023, yet 2023 was crossed out with 2025 written above it, signifying the IRS’ recent delay.

The types of plans to which they apply include 401(a), 403(b), and 457(b) plans sponsored by governments.

Eligible participants with IRC Section 3123(a) wages (FICA) for the preceding calendar year from the employer sponsoring the plan that exceeds $145,000 (indexed multiples of $5,000) are impacted and will no longer make pre-tax catch-up contributions.

Recent IRS guidance confirmed that individuals without FICA wages are not subject to the new rule (i.e., partners, self-employed), the two presenters said. It also clarified that a separate Roth election is not required if an eligible participant made a catch-up election. Lastly, it clarified that compensation among participating employers in multi-employer and multiple-employer plans is not required.

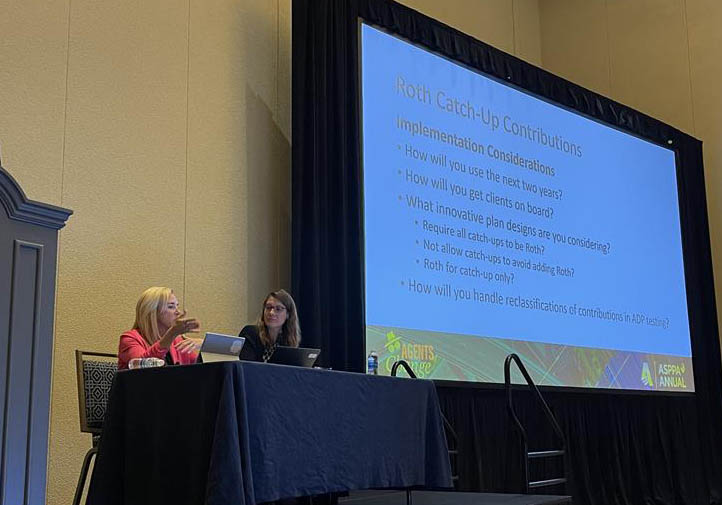

Edwards and Ueding then offered some questions for attendees to consider when implementing Roth catch-up contributions, including:

- How will you use the next two years?

- How will you get clients on board?

- What innovative plan designs are you considering?

- Will you require all catch-ups to be Roth?

- Will you not allow catch-ups in order to avoid adding a Roth option?

- How will you handle reclassifications of contributions in ADP testing?

For Roth employer contributions, designated contributions include matching and nonelective contributions in addition to elective deferrals, with an immediate effective date. “Applicable retirement plans” are defined in Section 402A and include 401(a), 403(b), and 457(b) plans sponsored by governments.

Like all Roth contributions, employer contributions must be made pursuant to a qualified Roth contribution program, they need separate accounts and accounting of contributions and earnings, must be an amount that would otherwise be excludible from gross income, and are made pursuant to an employee election.

Matching contributions on qualified student loan payments are included, and contributions must be nonforfeitable when received.

The session concluded with a discussion of Pension Linked Emergency Savings Accounts PLESA), which Edwards admitted she did not like. Used for short-term, emergency savings, a separate “designated Roth account” must be established. They allow elective deferrals only, and no transfers from other accounts are permitted.

PLESAs are in effect for years beginning after Dec. 31, 2023. Contributions are capped at $2,500 annually (indexed multiples of $100), and matching contributions are required if any match is made on elective deferrals under the plan.

They allow withdrawals for any purpose at least monthly and as soon as practicable after the election. The first four withdrawals each plan year are free, and subsequent withdrawals may have reasonable fees or charges.

- Log in to post comments