The release of final changes to the Department of Labor’s popular Voluntary Fiduciary Correction Program (VFCP) is apparently on the horizon, according to recent comments made by a senior agency official.

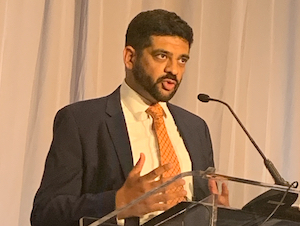

Speaking Feb. 27 at the U.S. Chamber of Commerce’s Small Business Retirement Summit, Principal Deputy Assistant Secretary Ali Khawar told attendees that the DOL’s Employee Benefits Security Administration (EBSA) will release final changes to the VFCP expansion “in the next few months.”

The comment period for proposed changes to the VFCP closed in late January 2023 after having been reopened, following enactment of the SECURE 2.0 Act. At that time, the American Retirement Association welcomed the proposal, noting that it will “promote more efficient and less costly corrections of fiduciary breaches by encouraging voluntary compliance by plan sponsors,” and offered a number of recommendations.

First released in November 2022, the changes would simplify and expand the original VFCP, “thereby making it easier for, and more useful to, employers and others who wish to avail themselves of the relief provided by the program,” according to an earlier release by the department.

Specifically, the program’s amendments would do the following:

- Add a self-correction feature;

- Clarify some existing transactions eligible for correction under the program;

- Expand the scope of other transactions currently eligible for correction; and

- Simplify certain administrative or procedural requirements for participating in and correcting transactions under the VFC Program.

According to the DOL, the most significant among the proposed changes is a self-correction component for employers that fail to send employee salary withholding contributions or participant loan repayments to retirement plans in a timely manner. This feature would enable employers and other plan officials to notify EBSA electronically that they have self-corrected certain failures to send participant contributions and loan repayments to pension plans on time.

That said, the self-correction component, as originally proposed, could only be used if the following conditions are met:

- Participant contributions or loan repayments to the plan must be remitted no more than 180 calendar days from the date of withholding or receipt.

- Lost earnings must not exceed $1,000 calculated from date of withholding or receipt.

- The plan or self-corrector must not be under investigation as defined in the program.

- Self-correctors must use the program’s online calculator to calculate lost earnings and an online web tool to complete and file the self-correction component notice.

- Self-correctors must also complete and retain the self-correction retention record checklist.

According to Khawar, the errors the DOL sees are often made by small businesses that are not necessarily acting in bad faith; rather, they are often due to staffing shortages or a lack of proper training—and permitting plan fiduciaries to correct these errors and avoid enforcement action is a preferred solution.

The VFCP under ERISA originally was adopted in 2002 and revised in 2005 and 2006. The VFCP is designed to encourage the voluntary correction of fiduciary violations by permitting persons to avoid potential civil actions and civil penalties if they take steps to correct identified violations in a manner consistent with the VFCP.

- Log in to post comments