|

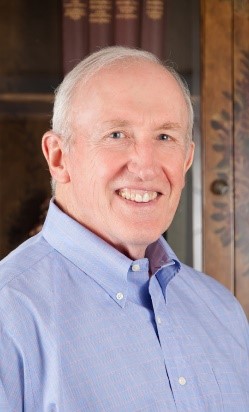

President Jeff James, CPA Audit Partner & Leader of the EBP Services Group |

Jeff James is a Partner and leader of Frazier & Deeter, LLC’s Employee Benefit Plan Services Group. His areas of expertise include employee benefit plan audit and compensation and benefits consulting matters. Jeff has more than 25 years of experience with qualified plans, welfare benefit plans, nonqualified plans and executive compensation issues. This experience is supported by a solid understanding of ERISA, DOL and IRS requirements and compliance, correction of plan defects, plan fiduciary responsibilities and reporting and disclosure in all areas of employee benefit plans. Before joining Frazier & Deeter, Jeff was the leader of the Employee Benefit Plan Audit practice for the State of Florida for Ernst & Young, LLP. During his tenure at EY, he was also a Senior Manager in the firm's Human Capital Consulting group. Jeff is a nationally recognized expert who speaks at events for the AICPA, SHRM, ASPPA and state CPA organizations.

|

President Elect Karen F. Burroughs ERPA, CPC, QPA, QKA |

Qualified Pension Administrators, Inc. (QPA) was established in 1995 by Karen Dixon-Burroughs to provide pension plan consulting, administration and record-keeping services. Today, the company is proud to support the retirement goals of hundreds of retirement plans and thousands of participants across the country in the qualified plan arena including daily 401(k), Defined Benefit, and ESOP plans. QPA has no affiliations with other companies, does not market a specific product, nor manage money. This independence affords us the flexibility and objectivity we want to maintain when providing our services and consulting strategy approach to our clients. QPA serves clients from two main offices located in Georgia and South Carolina.

|

Treasurer Scott Melton |

Scott is an assurance & advisory services Senior Manager who joined Frazier & Deeter in 2010. Scott specializes in providing assurance and business advisory services to clients with employee benefit plans of all sizes. His experience includes managing plan audits for all plan types – 401(k), defined benefit plans, welfare benefit plans and 403(b) plans. Scott also plays an integral role in the firm’s Form 5500 preparation process.

|

Co-Secretary Lance Reising |

Lance Reising, Investment Advisor Representative with Investors Asset Management of Georgia, Inc., serves as the Marketing Director for the firm’s Investor’s Choice program. Lance received his B. A. from Vanderbilt University and an M.B.A. from Georgia State University. He lives in Marietta with his lovely wife, Juliet, where they raised two children.

|

Co-secretary John Harris, QPA, ERPA, EA |

John Harris, QPA, ERPA, EA Bachelor of Science Degree, Accounting; University of Chicago State (Chicago, Illinois) Graduate Work in Taxation; University of Governors State (Park Forest, Illinois) 40+ Years in Retirement/Benefits, Accounting, Auditing and Taxation in both the Public Sector and Private Sector.

|

ABC Liaison David Hall |

David was born and raised in Atlanta, he is an alumnus of Marist School, and he earned his Bachelor’s Degree at Wake Forest University. Prior to joining Hall Benefits Law as Firm Manager, David was the Southeastern District Sales Manager for School Outfitters, a role in which he consulted with school districts throughout the region. He served for five years as an account executive with Quench USA, traveling throughout the United States. David also enjoyed a nine-year career as a teacher at The Schenck School, a private school in Atlanta. He is an avid golfer and reader.

|

VP of Programs Kevin O. Gaston, QPA, QKC, QKA, CPFA |

Kevin Gaston is a Strategic Relationship Manager for CUNA Mutual Retirement Solutions and has 14 years in financial services, with over 10 years in the qualified plan space. In this role he is an advocate for plan sponsors and financial advisors with plan design and best practices, and a voice for the participant, helping them achieve more secure retirement outcomes. Kevin volunteers his time in several financial literacy initiatives in Atlanta through local non-profits and his church.

|

VP of Membership Chris Moseley |

Vice President, Director of Business Strategy, Institutional Consulting At Graystone Consulting

|

Member at Large, Presidential Support Susan Koschewa, CPA |

Susan Koschewa, CPA is a Senior Manager in Frazier & Deeter’s Audit Department. She has served in the Employee Benefit Plan Service group for the past twelve years. Susan has experience with defined contribution, defined benefit, and health & welfare plans as well as public 11-K filings. In addition to fulfilling assurance needs, Susan leads the EBP training and methodology initiatives for the group. Susan brings more than 15 years of financial experience to Frazier & Deeter. She began her career with Arthur Andersen where she worked as an audit senior, supervising and administering audits and consulting projects for public and private companies. Susan served as Controller for The Sullivan Group of Florida and Colliers International, for a combined total of twelve years. In these roles, she was responsible for all financial and accounting functions for the commercial real estate and property management divisions.

|

Member at Large Rick Holland, AIF |

In April 2012, Rick joined AFS Advisors LLC, as Investment and ERISA Consultant and with over 15 years in the Defined Contribution Retirement Plan area, he consults for retirement plans, providing compliance oversight, interfacing with vendors on behalf of clients, price negotiations, investment fund selection and monitoring, as well as creating and delivering advisory presentations. Rick delivers these services while acting in a fiduciary capacity on behalf of his clients.