The Congressional Research Service (CRS) has provided an overview concerning the Social Security full retirement age (FRA) and what changes to it mean. This is especially timely since the effects of adjustments made under a reform measure enacted in 1983 are kicking in.

About the FRA

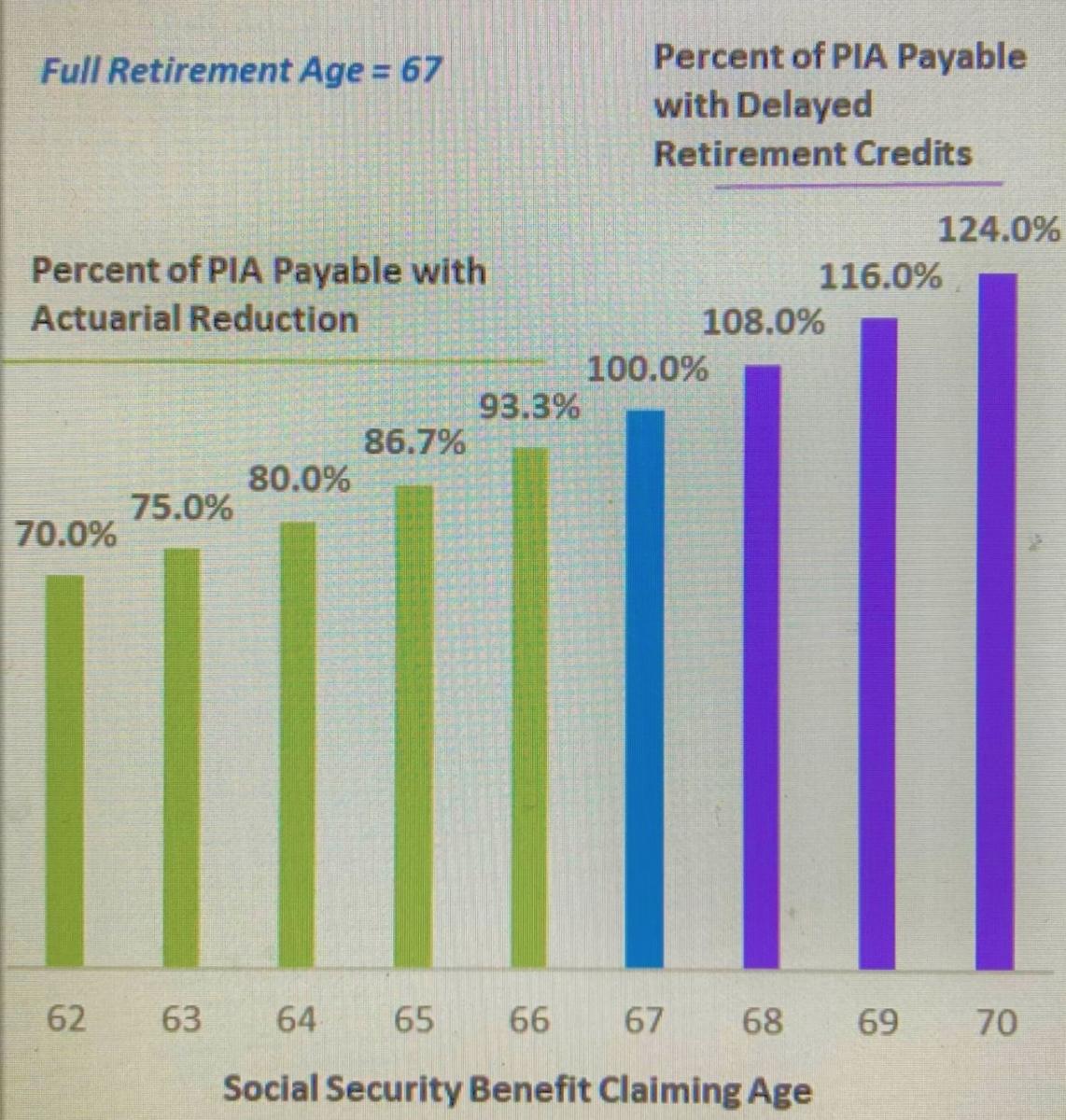

A worker’s monthly benefit amount is affected by the age at which he or she claims benefits relative to the FRA.

Benefit adjustments, which are intended to provide the worker with roughly the same total lifetime benefits regardless of when he or she claims benefits based on average life expectancy, are made based on the number of months before or after the FRA the worker claims benefits.

Claiming benefits before the FRA results in a permanent reduction in monthly benefits (to take into account the longer expected period of benefit receipt).

Claiming benefits after the FRA results in a permanent increase in monthly benefits (to take into account the shorter expected period of benefit receipt).

Changes to the FRA

The FRA was 65 when Social Security begin in the 1930s, the CRS reminds readers. The Social Security Amendments of 1983 included provisions that increased the FRA from 65 to 67 for workers born from 1938 to 1960. The FRA reaches 67 for those born in 1960 or later; that is, those who reached age 62 in 2022 or later and who will attain age 67 in 2027 or later.

The Effect of Changing the FRA

Changing the timing of claiming Social Security benefits affects their amount. When a worker claims benefits before the FRA, there is an actuarial reduction in monthly benefits. That reduction can be sizable and is permanent — all future monthly benefits are payable at the actuarially reduced amount, which equals a 6?% reduction each year.

Conversely, claiming benefits after the FRA results in delayed retirement credits (DRC). As with the actuarial reduction for early retirement, delayed retirement credits are permanent. Currently, the credit is an 8% increase per year. The maximum age at which the DRC applies is 70; any further delay in claiming benefits does not result in a higher benefit.

Effect of Claiming Age on Benefit Levels, Based on an FRA of 67

Source: CRS.

NOTE: PIA = primary insurance amount; that is, Social Security benefits payable at FRA.

The Bigger Picture

Since the increase in the FRA essentially reduces monthly benefits at all claiming ages, it reduces the cost of the Social Security program on average, says the report.

The CRS continues that research also shows that increasing the FRA encourages many people to work longer and delay claiming Social Security benefits; that, in turn increases payroll tax contributions for the program as well as the average claiming age.

- Log in to post comments