Fueled by strong market gains in the second half of 2020, a recent report finds that health savings account (HSA) investment assets soared to nearly $24 billion at the end of 2020.

The results of Devenir’s 21st semi-annual health savings account survey and research report reveal that the number of HSAs has now risen to an estimated 31.2 million, holding $87.3 billion in assets at the end of January 2021, up 6% since the end of 2020.

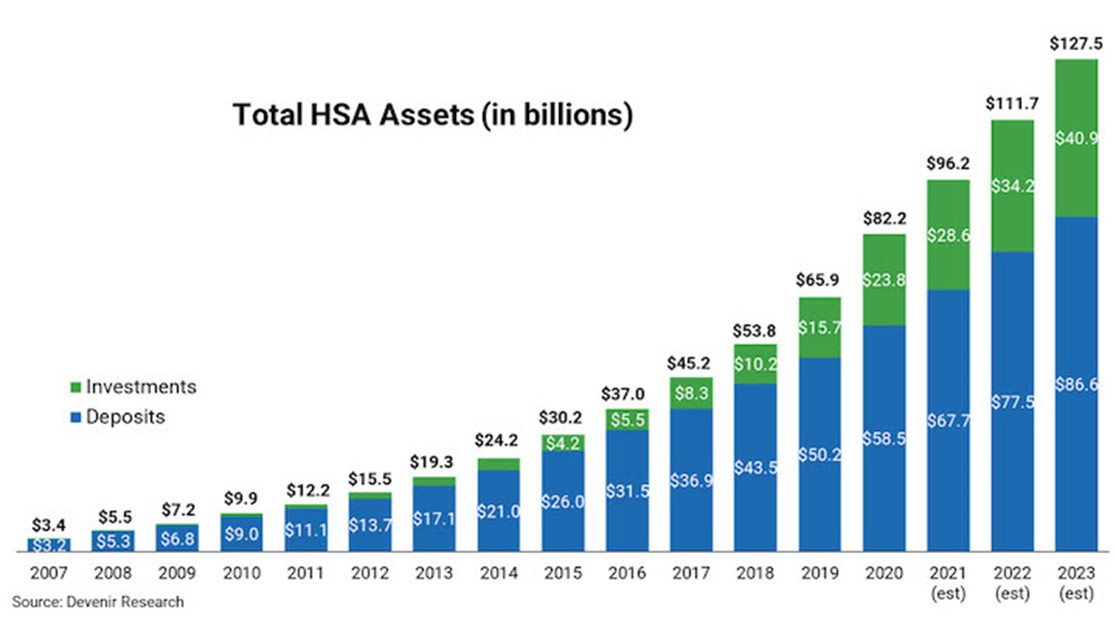

At year-end 2020, HSA assets stood at $82.2 billion in slightly more than 30 million accounts, which was a year-over-year increase of 25% for assets and 6% for accounts.

Devenir currently projects that the HSA market will exceed 36 million accounts by the end of 2023, holding more than $127 billion in assets. What’s more, there are now approximately 1.7 million accounts that are investing a portion of their HSA dollars, representing almost 6% of all accounts and 29% of all HSA assets as of year-end 2020.

On average, investment account holders hold a $17,926 total balance, including deposits and investments combined. But for those account holders who opened an account in 2004—and may be eyeing the triple tax benefits of saving their accounts for future medical expenses—the report shows that their average investor balance is nearly $60,000.

HSA contribution growth continues to outpace withdrawals. Account holders contributed nearly $42 billion to their accounts in 2020, up 8% from year prior, and withdrew slightly more than $30 billion from their accounts in 2020, up 4% from year prior.

Employer contributions made up 26% of all HSA dollars contributed to an account in 2020, with an average contribution of $870, among those making contributions.

In comparison, employee contributions comprised 59% of all HSA dollars contributed to an account. The average employee contribution was $2,054 for those making contributions.

“Despite the COVID-19 pandemic, a record $42 billion was contributed to health savings accounts during 2020. Account holders were able to tap their health savings accounts to help cover over $30 billion in medical expenses throughout the difficult year, while continuing to accumulate meaningful savings for future medical expenses,” notes Jon Robb, SVP of research and technology at Devenir.

The survey data was collected primarily in January of 2021 and consisted largely of top 100 HSA providers in the HSA market, with all data being collected for the period ending on Dec. 31, 2020.

- Log in to post comments