Fueled by strong market gains, HSA investment assets were up 73% year-over-year, soaring to more than $30 billion at the halfway mark of 2021, according to Devenir’s semi-annual health savings account report.

Fueled by strong market gains, HSA investment assets were up 73% year-over-year, soaring to more than $30 billion at the halfway mark of 2021, according to Devenir’s semi-annual health savings account report.

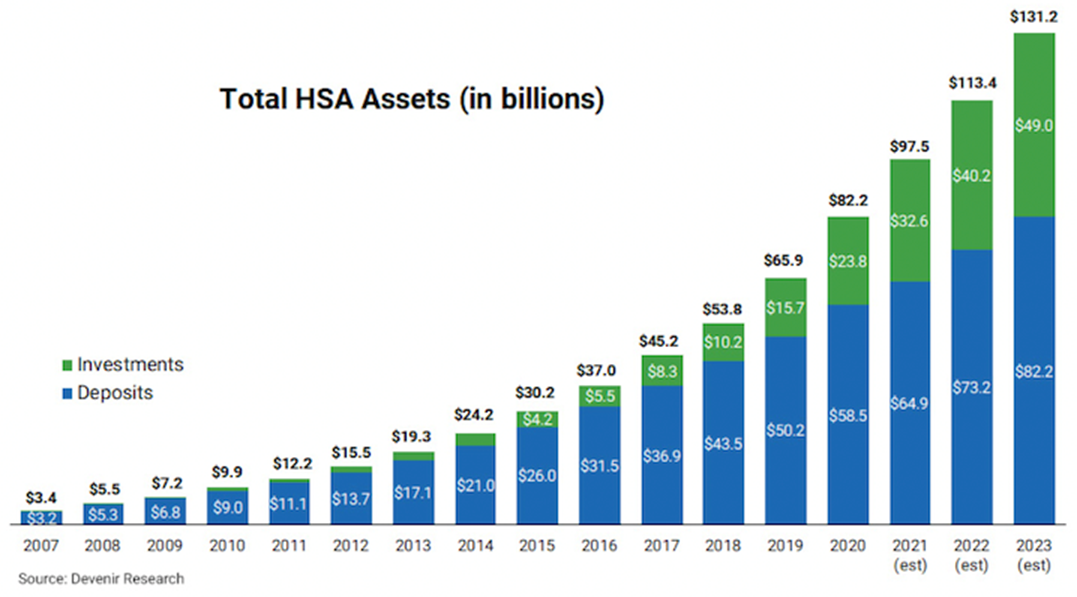

Devenir also found that there is now nearly $93 billion in more than 31 million HSAs—a year-over-year increase of 26% for assets and 6% for health savings accounts. The firm estimates that by year-end 2021, total HSA assets will equal $97.5 billion, with $32.6 billion in investments.

On average, investment account holders hold a $17,954 total balance (deposits and investments combined), which is 6.6 times larger than an average funded non-investment holder’s account balance.

“An increasing awareness of the role HSAs can play in planning for retirement healthcare costs and a strong stock market led to HSA investment assets soaring higher, with over 2 million accounts holding over $30 billion in invested assets at the 2021 midyear point,” notes Jon Robb, Senior Vice President of Research and Technology at Devenir.

As for future growth, the firm currently projects that the HSA market will exceed 36 million accounts by the end of 2023, holding over $131 billion in assets. HSA providers project HSA industry asset growth of 14% in 2021, which is down from 16% at the end of 2020, but they anticipate their own business will grow by 20% during the same period. Devenir notes that historically, HSA providers have been fairly accurate with their growth forecasts, but in both 2020 and 2019, HSA providers significantly underestimated HSA market asset growth.

The report’s findings are based on survey data collected for the period ending June 30, 2021, consisting largely of the top 100 HSA providers in the HSA market.

Contributions and Withdrawals

Contributions and Withdrawals

In the good news/bad news category, the report notes that HSA contribution and withdrawal growth were flat. Account holders contributed almost $24 billion to their accounts in the first half of 2021, which was up only 1% from the year prior. On a positive, however, account holders withdrew approximately $16 billion from their accounts in the first half of 2021, which was down 1% from year prior.

Additional findings show that 31% of all HSA dollars contributed to an account came from an employer during the first half of 2021. For those making contributions, the average employer contribution was $658.

In comparison, 55% of all HSA dollars contributed to an account came from an employee, with an average employee contribution of $1,184 for those making contributions.

Devenir also reports that, due in part to headwinds created by the COVID-19 pandemic and the related impacts to the employment market, account growth slowed in 2020 and has continued to lag during the first half of 2021. “We continue to see seasonality in the percentage of accounts that are unfunded. Accounts are often opened during the fall open enrollment season, but remain unfunded until early the following year,” the report explains. Halfway through 2021, about 18% of all accounts were unfunded, which is unchanged from a year ago.

- Log in to post comments