With U.S. employers adding one million jobs to the economy in the first quarter of 2023, Americans appear to be refocusing on investing in their future, according to Fidelity’s latest retirement trends analysis.

Among other things, the firm reports in its Q1 2023 Retirement Analysis that 401(k) account balances are up for the second quarter in a row due to improving market conditions and an increase in contributions from employers. Additionally, total 401(k) savings rates improved and Gen Z-ers continued to make impressive gains in retirement savings, across both 401(k)s and IRAs.

Among other things, the firm reports in its Q1 2023 Retirement Analysis that 401(k) account balances are up for the second quarter in a row due to improving market conditions and an increase in contributions from employers. Additionally, total 401(k) savings rates improved and Gen Z-ers continued to make impressive gains in retirement savings, across both 401(k)s and IRAs.

Total savings rate for the first quarter—which reflects a combination of employer and employee 401(k) contributions—improved to 14% (compared to 13.7% in Q4 2022 and 13.8% in Q3 2022), returning to the savings seen at the start of market volatility in Q1 2022. Boomers still in the workforce continue to save at the highest levels (16.7% versus 16.5% last quarter) and Gen Z saving levels have inched up as well (10.5% versus 10.2% last quarter).

Part of this success can be attributed to the fact that the average 401(k) employer contribution, which includes profit sharing and matching contributions, reached a record 4.8% in Q1 (this figure is based on data from 24,800 corporate DC plans and 22.7 million participants as of March 31, 2023).

In addition, more than 8 in 10 (85%) of workers received some type of employer 401(k) contribution in Q1 and 78% of workers contributed to their 401(k) at a level to allow them to get the full matching contribution offered by their employer. The most popular 401(k) match formula is based on a 5% employee contribution rate—100% match on the first 3%, then a 50% match on the next 2%. Almost half (44%) of 401(k) plans on Fidelity’s platform offer this match formula.

Fidelity further observes that the significant number of new workers underscored the benefits of auto enrollment, which is now used by 38.5% of plans on Fidelity’s platform (up from 33% five years ago). As a result, 575,000 new workers were automatically enrolled in their new employer’s plan in the first quarter, compared with 669,000 in the first quarter of last year and 526,000 in Q1 2021.

“We are encouraged to see positive gains for retirement savers, evidenced through rising account balances, improved savings rates, and a commitment by employers—including small businesses—to help employees prepare for the future,” said Kevin Barry, President of Workplace Investing at Fidelity Investments. “Americans have experienced some tumultuous years, but through Congress’ investment in retirement savings through the Secure Act of 2019, as well as individuals’ continued commitment to save, we are optimistic for the future of retirement security.”

Balances Increasing

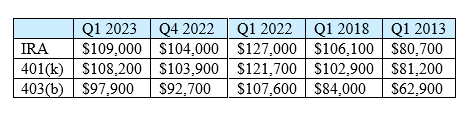

As most have probably experienced, the last year and a half has been a bit of a rollercoaster, as shown in the chart below. The average 401(k) balance increased to $108,200, up 4% from Q4 2022 but still down from Q1 2022. For 403(b)s, the average account balance increased to $97,900, up 6% from last quarter and a 16% increase from five years ago.

Average Retirement Account Balances

Additional findings show that outstanding 401(k) loans and average loan amounts continue to trend downward. The percentage of participants with a loan outstanding dropped to an all-time low of 16.6% for Q1 2023—down just slightly from last quarter (16.7%) and down from 21% five years ago.

Gen Z on the Move

As alluded to previously, Gen Z-ers continued along an upward savings trajectory, making strong advances on a number of fronts.

For Gen Z-ers with a 401(k), the average account balance increased by 17% over last quarter—a slightly smaller increase than the previous quarter (a 23% increase), but still the highest of any age group. What’s more, compared to Q1 2022, Gen Z account balances are up 34%, making them the generation with the most account growth over the last year (of course, having lower average account balances helps to drive up the percentage increase).

Additionally, Gen Z saw a 25% increase in IRA accounts opened in Q1 as compared to a year ago. Gen Z females saw a 22% increase in IRA accounts opened and female Millennials had a year-over-year increase of 19%.

The Q1 2023 analysis is based on the savings behaviors and account balances for more than 44.5 million IRA, 401(k) and 403(b) retirement accounts.

- Log in to post comments