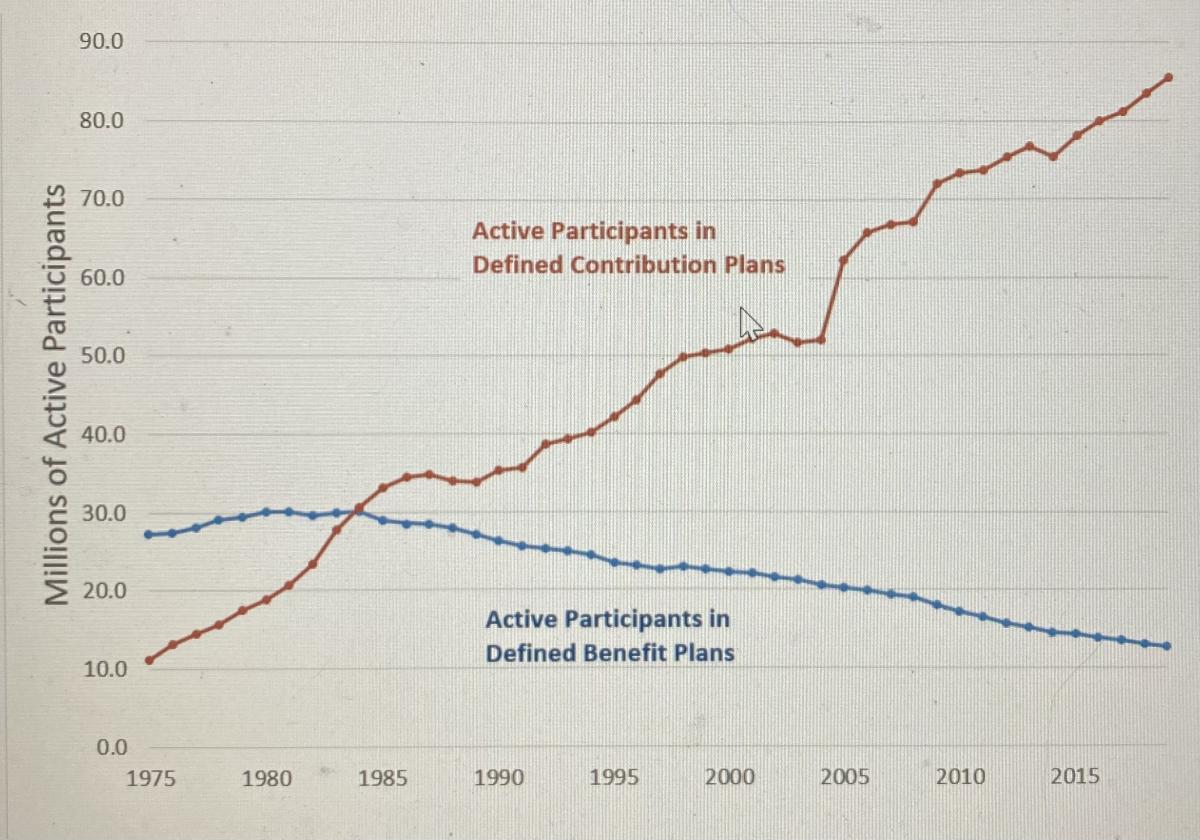

A new report from the Congressional Research Service (CRS) provides an illustration of the shift from defined benefit plans to defined contribution plans that has taken place in the last 40 years.

“One of the notable trends in the U.S. retirement system over the past five decades is that private-sector employees have become less likely to be covered by defined benefit (DB) pension plans and more likely to be covered by defined contribution (DC) pension plans,” writes the CRS.

Then

In 1975, there were 27.2 million active participants in private-sector DB plans, and 11.2 million in private-sector DC plans.

Now

In 2019, says the CRS, there were 12.6 million active participants in private-sector DB plans, and 85.5 million in private-sector DC plans. In 2021, says the report, 68% of private-sector workers, 68% had access to either a DB or DC plan, or both; 15% had access to a DB plan, while 65% had access to a DC plan.

Why?

The CRS attributes this shift to several factors:

- higher employer costs for DB plans than for DC plans, because employers typically entirely fund DB plan benefits, whereas they provide a smaller portion of DC plan benefits;

- employer contributions are more predictable than those to a DB plan, since the latter can be affected by investment instability;

- DC plan account balances are portable, whereas DB plan benefits are not; and

- more onus is placed on employees in to make decisions and handle risk with DC plans.

Graphically

The CRS has prepared a graphic to illustrate the shift.

Active Participants in Private-Sector Pension Plans 1975-2019

- Log in to post comments