Practice Management

CalSavers, the state-run retirement plan that covers private-sector employees whose employers don’t offer a plan, is growing — but so far this year, the expansion in assets is outstripping that of registrations.

Registrations

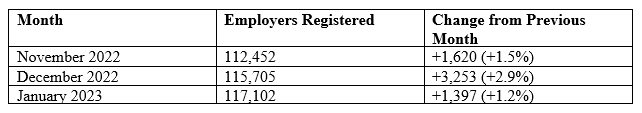

Month-to-month growth in employer registrations was still relatively robust as 2022 ground to a close and 2023 began:

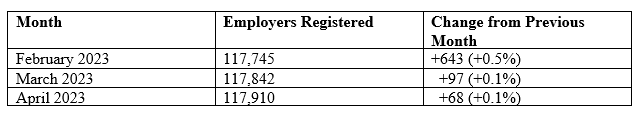

But since then, more than six months after the last employer deadline, that month-to-month growth is much slower:

Assets

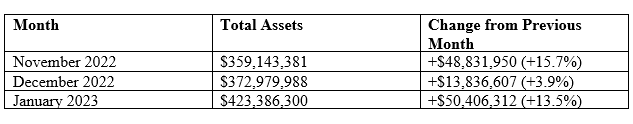

Month-to-month growth in CalSavers’ total assets was strong as the old year ended and the new one began:

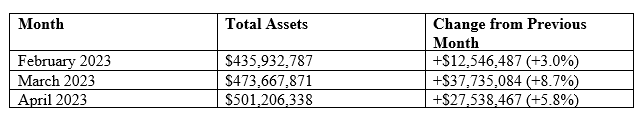

Since then, month-to-month growth is somewhat slower, but nonetheless grew at a far greater pace than that of employer registrations during the same period:

Why?

This could simply reflect the fact that the deadlines for registration have long since passed. The initial rush to register with the program may simply have waned.

CalSavers was launched on July 1, 2019. Registration had been rolled out gradually, based on the size of an employer’s workforce. The first deadline by which employers were to register with CalSavers or offer a plan of their own was Sept. 30, 2020, and applied to employers with 100 or more employees; the most recent one, the deadline by which employers in California with five or more employees had to offer a plan or else — was June 30, 2022.

At the same time, the revenue from the increasing pool of employers grew, as did the effect of compounding.

Finding out More

More information is available about CalSavers registrations and assets here: https://www.treasurer.ca.gov/calsavers/reports/2023/index.asp

- Log in to post comments