Much has been written about the “retirement crisis.” But it has been hard to sort out how what is happening today is different from, say, the 1990s. Hasn’t saving for anything, especially for something as abstract and far off as retirement, always been hard?

In what follows we argue that critical market fundamentals have, over the last 20 years (at least), changed so much that the cost of producing an adequate retirement—the reduced returns to saving and the increased cost of retirement income—has increased. And not just a little bit.

The Retirement Savings Project: Money vs. Time

Retirement savings involves taking money that is earned today (by an active wage-earner) and moving it into the future, so that ultimately it becomes income in the future—that is, it is changed from working income to retirement income.

This project involves, first, an act of saving—diverting current wages from current consumption towards retirement savings. At its simplest, these current savings may be traded with (loaned to) someone who does want to consume today, in exchange for a promise by the borrower that he will in the future return these savings to the (retirement) saver. The borrower here typically pays interest on this loan, reflecting what is often called the “time value of money”—the (higher) value of consumption today vs. consumption in the future.

In a more sophisticated version of this process, the individual’s retirement savings are invested, that is provided to a firm/entrepreneur in return for an interest in the future profits of that firm.

What the foregoing mumbo jumbo means, in real life, is simply that a worker’s (personal) retirement savings project—producing retirement income—is fundamentally determined by the financial markets: interest rates and the returns on saving/investment. And the decline in interest rates and returns over the past generation have made saving for retirement/producing retirement income significantly more expensive.

It all Comes Back to Interest Rates

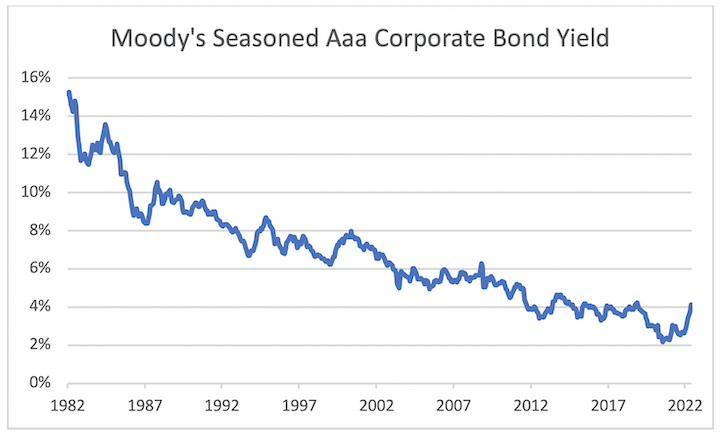

The critical driver of the increasing cost of retirement income and the decreasing returns to saving has been the long-run decline in interest rates. Here is a chart of the yield on high quality corporate bonds from their peak in 1982.

Source: St. Louis Federal Reserve Bank

(For a discussion of why rates are so low (and likely to stay that way), see “What’s (Really) Driving Interest in Interest Rates?" Bottom line: None of this is going to change until we do something about declining birth rates.)

Interest Rate Declines also Increase the Cost of Retirement Income

Obviously, this decline means that fixed income investors are getting less and less on their savings.

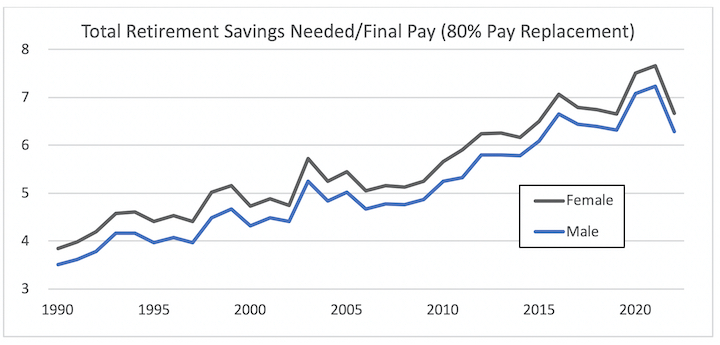

But this long-run decline in interest rates also (and necessarily) correlates with a corresponding increase in the cost of retirement income, that is, how much retirement income a dollar can buy. That increase has significantly exceeded the increase in wages. Here is a chart showing the increase in the cost at retirement of an adequate income (80% replacement ratio (based on savings + Social Security) for (as of a given date) a worker retiring at age 65 making 125% of the median wage, over the period 1990-present.

How we derived this chart and what it is showing requires some explanation. For the period covered, we first calculated an 80% retirement income target for an individual making 125% of median wages at age 65 for participants retiring each year (1990-2021). We then determined the cost of “buying” retirement income for that year based on annuity purchase rate data from the Annuity Shopper Buyer’s Guide. We then calculated the total savings the individual would need to, in combination with Social Security, produce the targeted 80% pay replacement. Finally, we divide this amount by final pay (that is, pay at retirement).

The result is a factor/heuristic this is commonly used to describe how much a worker needs to accumulate for retirement, as in “For an adequate retirement income, you need to have X times your final pay.” On this data, a worker retiring in 1990 needed to accumulate 3.5/3.8 times final pay (male/female) to buy an adequate retirement income. A worker retiring in 2021 must have nearly double that—6.3/6.7 times pay.

Equity Returns

The situation with equity returns is more complicated. For any given year, the broad equity markets are affected by (at least) two factors. First, business conditions. And second (and once again), interest rates.

The effect of interest rates on returns may need some explaining. First, and obviously, interest rates represent an alternative cost of/return to capital and thus put pressure (up or down, depending on whether they are increasing or declining) on equity returns.

Second (and perhaps less intuitively for non-financial readers), interest rates affect the market valuation discount rate (e.g., the P/E ratio). A decline in interest rates, with no change in any other factor (critically, no change in projected earnings), will necessarily result in an increase in stock values. Just as a decline in interest rate results in an increase in bond values.

To illustrate: the extraordinary stock market returns in 2019 (the S&P 500 returned 31.49%) can be nearly entirely attributed to the similarly extraordinary decline in interest rates that year (the Moody’s AAA index tracked above declined nearly 100 bps). The result is that the gain in asset value is offset by an increase in the cost of income (i.e., a reduction in the return on saving).

On the other hand, there are years when equity returns represent real gains, that is, gains net of interest rate effects.

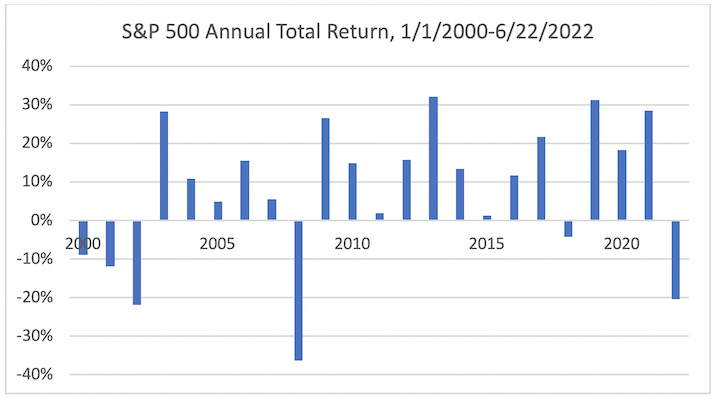

There is, nevertheless, no question that stock returns declined over the period 2000-2022—he S&P 500 has earned a 6.1% nominal CAGR (compound annual growth rate) over the past 22.5 years (that is, since 2000).

This decline is (by definition) inevitable. As we said above, on balance, equity returns will follow interest rate returns, unless there is a fundamental change in the equity premium.

The above is a sketch of some really broad trends—an increase in the cost of retirement income and a decrease in returns saving—that all point in the same direction: a significant increase in the cost of saving for retirement.

Nevertheless, where a saver already has significant retirement assets, these effects have been, to an extent, offset by gains on her asset portfolio. Thus, it very much matters when you entered the workforce and began saving. Individuals starting work in 1990 have been less affected by these changes than those starting work in, say, 2000.

Next: Calculating how the increased cost of retirement income/lower returns to saving affects the paycheck. In our next article, we want to examine how these changes affect ordinary American workers’ paychecks—how much more they have to save (and thus how much they have to reduce consumption) to provide an adequate or comfortable retirement. And how these changes have affected different age cohorts—Boomers, GenX, Millennials and Zoomers.

Michael P. Barry is a senior consultant at October Three and President of O3 Plan Advisory Services LLC, which provides retirement plan regulatory analysis targeted at plan sponsors and those who provide services to them. Brian Donohue is a member of October Three’s actuarial consulting team and part of the senior leadership for October Three.

Opinions expressed are those of the authors, and do not necessarily reflect the views of ASPPA or its members.

- Log in to post comments