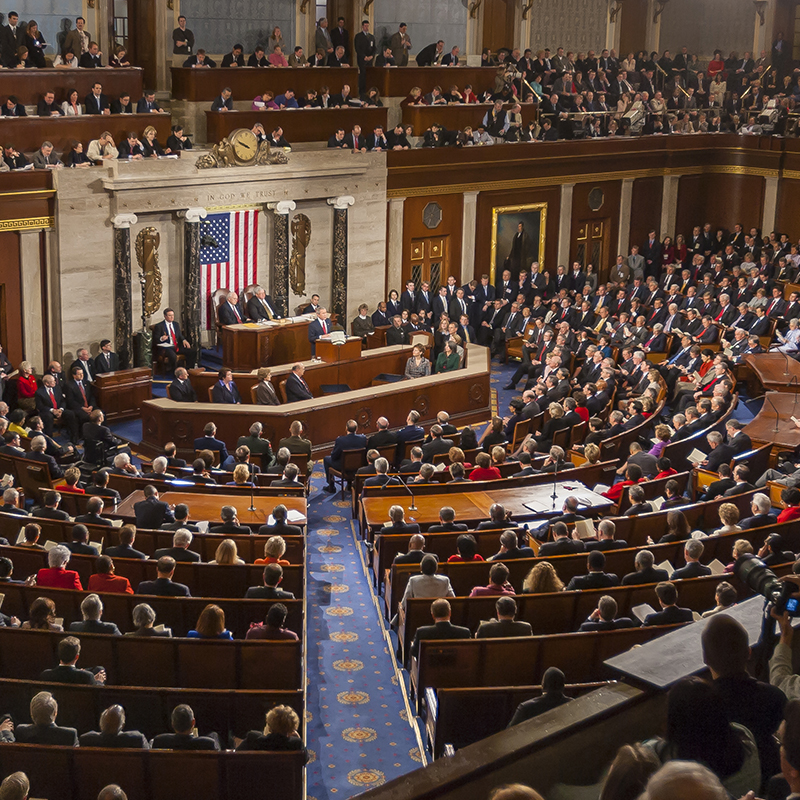

Key members of the House of Representatives have reintroduced legislation to allow retirement plan sponsors to provide annuities as a default option in their DC plans.

Key members of the House of Representatives have reintroduced legislation to allow retirement plan sponsors to provide annuities as a default option in their DC plans.

Reps. Donald Norcross (D-NJ) and Tim Walberg (R-MI), who serve together on the House Committee on Education and Labor’s Health, Employment, Labor and Pensions (HELP) Subcommittee, on Feb. 15 reintroduced the Lifetime Income for Employees (LIFE) Act of 2022. The legislation was referred to the House Education and Labor Committee, on which both members serve.

While the SECURE Act provided a fiduciary safe harbor for the selection of a lifetime income provider, this bill would go one step further, allowing annuities to be a default in employer-provided 401(k) plans. More specifically, the bill would allow fiduciaries to make default investment arrangements in annuity contracts upon providing certain notice to plan participants and complying with certain prohibitions on liquidity restrictions.

Among the bill’s requirements:

- The annuity contract cannot impose a liquidity restriction on the transfer of invested amounts during the 180-day period beginning on the date of the initial investment in such contract by the participant or beneficiary.

- The fiduciary must ensure that each participant or beneficiary is provided not later than 30 days before the date of the imposition of a liquidity restriction written notice that explains, among other things:

- the circumstances under which assets in the account may be invested on behalf of the participant or beneficiary in the annuity contract;

- the rights of the participant or beneficiary to direct or transfer amounts invested, or to be invested, in an annuity contract to other investment alternatives available under the plan;

- the general workings of the annuity contract; and

- how a participant or beneficiary may obtain additional information, including a copy of the contract.

In addition, the fiduciary cannot allocate more than 50% of any periodic contribution or, immediately after a rebalancing of account investments, 50% of the value of the assets of the account, to the annuity contract.

In touting a need for the legislation, Norcross cites data showing that the number of private-sector workers receiving lifetime benefits from a traditional defined benefit pension plan has declined from 60% in the 1980s to only 4% today. “As a retired electrician, I know first-hand how important pensions are to workers who rely on them for their retirement,” says Norcross. “By creating ‘individual pensions,’ this legislation will provide hard-working Americans with a guaranteed income so they can retire with dignity.”

“For too many families, the thought of having enough set aside for their retirement years remains out of reach,” adds Walberg. “Encouraging and increasing access to savings options will help provide workers with greater peace of mind that their income will last throughout retirement. I am pleased to work with Rep. Norcross on this bipartisan effort to help families achieve financial security after a lifetime of hard work.”

The text of the bill is not yet available.

- Log in to post comments