While many employers made difficult cost-cutting decisions during the pandemic, a new survey finds that most feel responsible for their employees and are addressing their needs through enhanced benefit offerings and business practices.

While many employers made difficult cost-cutting decisions during the pandemic, a new survey finds that most feel responsible for their employees and are addressing their needs through enhanced benefit offerings and business practices.

The report from the Transamerica Institute and its Transamerica Center for Retirement Studies (TCRS) reveals that 81% of employers feel responsible for helping employees maintain their long-term health and well-being, while 72% cite one or more major concerns about employees’ mental health. In addition, 47% have found it difficult to recruit new employees, according to “Emerging From the COVID-19 Pandemic: The Employer’s Perspective,” which is based on a survey of more than 1,800 for-profit company employers.

In examining the impacts of the pandemic on employers, the survey found that more than half (56%) have reevaluated their health, retirement and other employee benefit offerings since the pandemic began. Not surprisingly, medium and large companies (83% and 81%, respectively) are more likely to have done so than small companies (50%).

Among all employers, the reasons for reevaluating benefits are to align with employees’ current needs (30%), make them more competitive (25%), reduce costs (22%) and for benchmarking purposes (13%). Another 16% of employers have not reevaluated their benefits plans, but plan to do so.

By late 2021, more than two-thirds of employers (67%) had implemented one or more beneficial measures for their employees, TCRS found. The most often cited beneficial measures include:

- implemented/enhanced employee work-life balance programs (30%);

- increased salaries (25%);

- implemented/enhanced health care benefits (22%);

- implemented/enhanced retirement benefits (18%); and

- increased bonuses (18%).

And once again, medium and large companies (86% and 85%, respectively) were more likely to have implemented beneficial measures than small companies (62%).

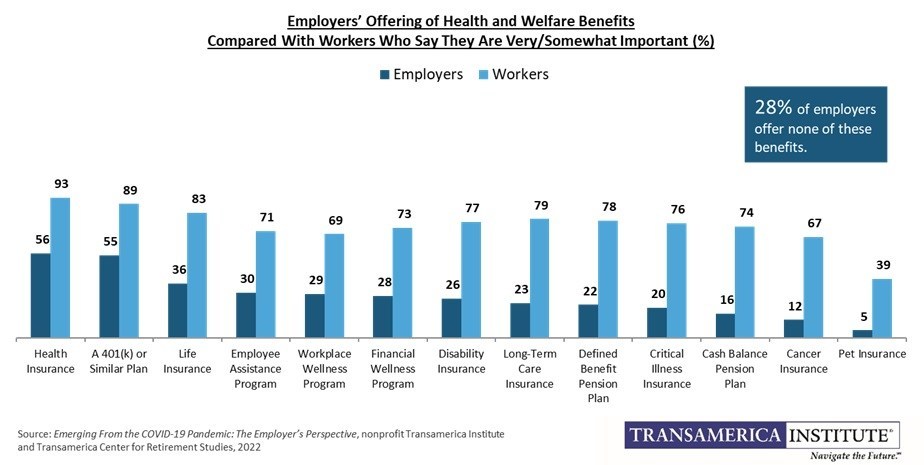

In doing so, the survey also found that nearly two-thirds of employers (64%) believe health insurance, retirement benefits and other benefits to be very important in their ability to attract and retain employees. Yet, despite this emphasis on employee benefits, there is still a sizeable shortfall when comparing the percentage of employers that offer specific benefits with the percentage of workers who value them as important, as shown below.

“As employers evaluate their benefits offering, they have an opportunity to further support the physical and mental health and the financial well-being of their employees,” notes Catherine Collinson, CEO and president of Transamerica Institute and TCRS. “Employer-sponsored retirement plans, including 401(k)s and similar plans, have proven to be the most effective way to facilitate long-term savings among workers. Unfortunately, not all workers have access to these benefits, especially those working for small companies,” adds Collinson.

The Access Gap

In fact, this is a problem that has existed for many years now, as TCRS found that 55% of employers offer a 401(k) or similar plan to their employees. But when looked at by company size, these DC plans are more commonly offered by large and medium companies (92% and 89%, respectively), compared with small companies (46%) where the opportunity for expanding retirement plan coverage is greatest.

That said, more employers may offer a retirement plan in the future. Among employers that do not offer a 401(k) or similar plan, 43% say they are likely to begin doing so in the next two years. Moreover, 27% of employers unlikely to offer a plan say they would consider joining a multiple employer plan (MEP), pooled employer plan (PEP) or group of plans (GoP).

The survey also finds a sizeable gap in retirement savings among workers by company size. TCRS suggests that this gap illustrates the impact that access to workplace retirement benefits can make. For instance, workers of large companies have saved $96,000 in total household retirement accounts and those of medium-sized companies have saved $73,000, while small company workers have saved just $41,000 (estimated medians).

And as pre-retirees face complex financial decisions, TCRS suggests that plan sponsors could do more to help workers financially transition to retirement. In this case, the survey found that relatively few plan sponsors provide access to a financial advisor (44%), education about transitioning into retirement (41%) and educational resources (40%).

Multigenerational Workforce

The survey also finds many employers are embracing a multigenerational workforce in some respects but, in other ways, they have not yet addressed the opportunity. For example, 9 in 10 (92%) offer one or more types of alternative work arrangements. In contrast, only 3 in 10 (31%) have a formal phased retirement program with specific provisions and requirements. But regardless of whether they offer a formal program, some employers have work-related programs to help pre-retirees transition, including flexible work schedules and arrangements (44%), the ability to reduce hours and shift from full-time to part-time (36%), and the ability to take on less stressful or demanding jobs (34%).

“Today, four generations in the workforce bring diverse skills, expertise, and life experiences to their jobs. Employers that implement best practices for a multigenerational workforce can potentially increase productivity while supporting the professional growth and work-life balance of their employees,” says Collinson.

The findings in the report are based on the results of two surveys. This included an online survey conducted within the U.S. by The Harris Poll between Nov. 8–24, 2021, among a national sample of 1,874 U.S. business executives who make decisions about employee benefits at their for-profit company and employ one or more employees. A worker survey was conducted between Oct. 28–Dec. 10, 2021, among a nationally representative sample of 5,493 U.S. adults who work full- or part-time in a for-profit company employing one or more employees.

- Log in to post comments